Corporate credit cards

Take control of business expenses while empowering your employees with corporate credit cards from Bank of America. We have a range of widely accepted corporate credit cards that offer extensive reporting, powerful benefits and award-winning customer service. It’s another way we’re making business easier.

Business credit cards

Corporate Card

Easily manage business travel and spend with a single solution:

- Set spending limits and implement custom controls to optimize cash flow

- Increase visibility into spending and reconciliation benefits

- Mitigate fraud risk through enhanced security features

- Earn rewards and enjoy benefits

Executive Explorer Card

Provide an exclusive experience to your executives with elite perks:

- Extensive global acceptance

- White-glove service and concierge

- Statement credits for airport lounge access and airport fast track

Benefits and tools

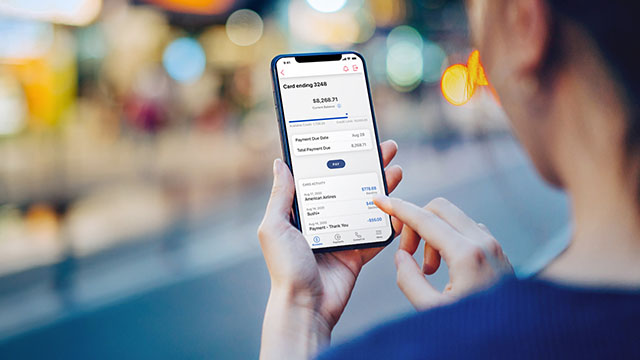

Manage your cards from anywhere, enjoy perks and earn rewards.

Global Card Access

Manage your card and access reports from anywhere with our online portal and mobile app

Take your payables program to the next level

Our digital AP solutions can help increase workforce efficiency and mitigate fraud risk.

Streamline your AP process

Intelligent Payables are designed to grow with your business and meet your evolving AP needs.

Featured insights

Frequently asked questions

Contact us

To get started with a corporate credit card program or for help choosing one that’s right for your business, contact your Bank of America representative today.