For the second consecutive year, Bank of America received the No. 1 score for leadership and digital channels in the annual Coalition Greenwich Digital Transformation Benchmarking Study.

CashPro®

Your complete digital banking platform

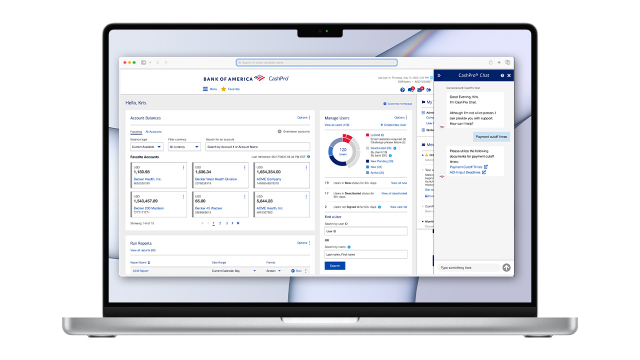

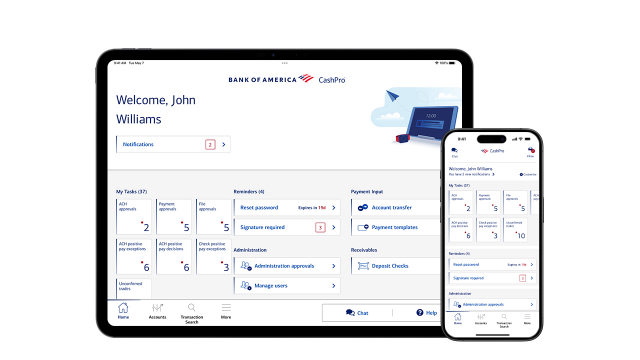

CashPro® is a powerful and intelligent solution for payments, receivables, liquidity, investments, FX, and trade. It’s designed to optimize, protect and enable the financial performance of your business from a single platform.

CashPro Stories

What does CashPro mean to you? That's what we asked clients, and the outcome was CashPro Stories – a video series that brings the platform to vivid life, featuring clients from diverse sectors discussing how CashPro helps make business easier.

Data-driven insights

Get personalized, actionable insights on your payments, security and more with CashPro’s data intelligence suite.

24/7 digital support

Get streamlined access to all your banking data and instant answers to your questions using CashPro Chat with Erica®, our virtual service advisor.

Client-led innovation

Clients influence everything we build. Your feedback helps us deliver the best possible solutions for the unique challenges you face.

Strong partner network

We build meaningful partnerships with industry-leading third-party treasury providers, allowing you to easily access CashPro through your preferred business platform.

Convenient access

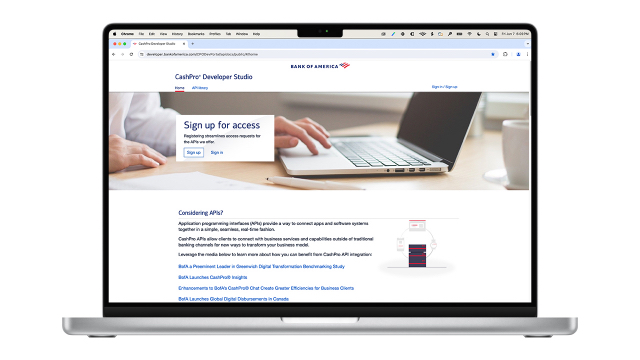

CashPro API

Integrate your CashPro data directly into your enterprise software using CashPro APIs

How to decide if APIs are right for your treasury needs

CashPro Connect

File transmission that offers flexibility, integration and automation between your systems

Get started with CashPro today

Contact a Bank of America treasury officer to learn how CashPro can make your business easier.