Designed with flexibility in mind, BofA Working Capital Manager makes it easy to optimize working capital for your business.

Talk to your relationship manager to learn more. Don’t have one? We can help.

Designed with flexibility in mind, BofA Working Capital Manager makes it easy to optimize working capital for your business.

Talk to your relationship manager to learn more. Don’t have one? We can help.

The suite includes Treasury Solutions at a flat monthly fee. Plus additional products such as Credit, Business Credit Cards and Merchant Services with predictive pricing you can rely on.

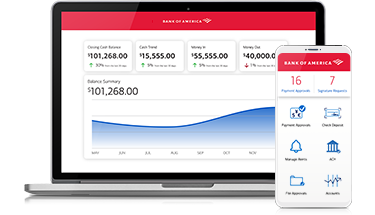

A complete digital platform with cash management tools that allows you efficiently manage payments, receipts, liquidity, and more; includes Check and ACH Positive Pay and robust account management and reporting tools.

With our Commercial and Business Advantage credit cards you get robust controls to help manage employee spending and comprehensive reporting and account management tools – plus you can earn rewards on every purchase you make.

Our credit solutions are designed to provide easier access to working capital to help with your liquidity needs or finance a variety of expenditures such as real estate, equipment or technology. All with a streamlined documentation process and electronic document signing, which means a simpler, faster process to fund your loans.

An all-in-one solution for banking and payments processing. Improved cash flow, security, support, scalability and flexibility make managing your business easy and speedy.

Keeping your business secure is of the utmost importance. Working Capital Manager has state-of the-art fraud protection and detection built into every component, not as an add-on. And you can safely access and manage your accounts from anywhere with the CashPro® Mobile App.

Our Relationship Managers are ready to help businesses with $5 to $50 million in revenue. We live and work in your community and are committed to helping your business succeed. If you’re already working with a Bank of America Relationship Manager, talk to them today. If not, we can help you find one.