1 Mobile Banking requires that you download the Mobile Banking app and is only available for select mobile devices. Message and data rates may apply.

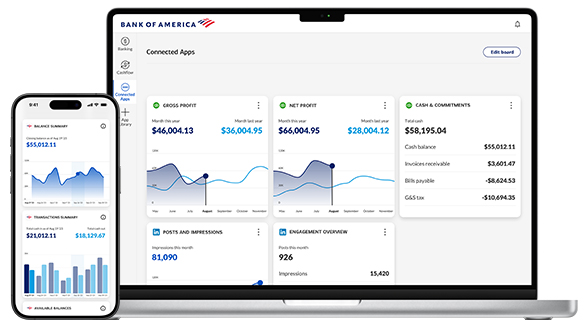

2 Connected Apps You must be enrolled in Business Advantage 360, our small business online banking, or Mobile Banking to use Cash Flow Monitor and Connected Apps, and have an eligible Bank of America" small business deposit account. Mobile Banking requires that you download the Mobile Banking app and is only available for select mobile devices. Message and data rates may apply. When you use Cash Flow Monitor and Connected Apps to access services or information from third parties ("Third-Party Account Information"), you will be subject to any terms and conditions established by those third parties, in addition to the Cash Flow Monitor and Connected Apps Terms and Conditions. Bank of America, N.A. provides access to third-party websites and Third-Party Account Information only as a convenience, and is not responsible for, does not guarantee or endorse the services offered, and does not monitor or review such information for accuracy, completeness or otherwise. Information displayed through Cash Flow Monitor and Connected Apps may be more up to date when obtained directly from relevant third-party web sites. Neither Bank of America, its affiliates, nor their employees provide legal, accounting and tax advice.

Bank of America and/or its affiliates or service providers may receive compensation from third parties for clients' use of their services. All third-party trademarks, service marks, trade names and logos referenced in this material are the property of their respective owners. Bank of America does not deliver and is not responsible for the products, services or performance of any third party .

3 Business Credit Scores Access to Dun & Bradstreet business credit score information in Business Advantage 360, our small business online banking platform, is solely for educational purposes and available only to U.S.-based Bank of America, N.A. Small Business clients with an open and active Small Business account, who have Dun & Bradstreet business credit scores and have properly enrolled to access this information through Business Advantage 360 using a small business online banking ID. Only the Business Advantage 360 account owner is eligible to enroll; administrators or sub-users are excluded. This information is not accessible through Mobile Banking.

Dun & Bradstreet's business credit scores (also known as "The D&B" Delinquency Predictor Score• and •The D&B® Small Business Financial Exchange (SBFE) Score') are based on data from Dun & Bradstreet and may be different from other business credit scores. These business credit scores are created using Dun & Bradstreet's proprietary models and determined based on information in the Dun & Bradstreet Data Cloud at the time your Dun & Bradstreet business credit scores are calculated. Additionally, the D&B SBFE Score includes financial services payment data reported to the SBFE by its member financial services companies. Bank of America and other lenders may use other credit scores and additional information to make credit decisions.

Dun & Bradstreet is a third party not affiliated with Bank of America and Bank of America makes no representation or warranty related to Dun & Bradstreet's business credit score or any related content.

4 Owner occupied commercial real estate will be determined in underwriting and requires occupancy by the borrower/guarantor. Please note SBA guidelines require at least 51% occupancy to be considered Owner Occupied. Small Business Administration (SBA) loans provide up to 90% financing. Requires approval through the SBA 7(a), SBA 504 or SBA Express programs. Subject to credit approval. Bank of America credit standards, loan terms, collateral and documentation requirements apply and are subject to SBA guidelines.

5 All programs subject to credit approval and loan amounts are subject to creditworthiness. The term, amount, interest rate, and repayment schedule for your loan, and any product features may vary depending on your creditworthiness and on the type, amount and collateral for your loan. Bank of America may prohibit use of an account to pay off or pay down another Bank of America account. Repayment structure, prepayment options and early payoff are all subject to product availability and credit approval. Other underwriting standards and restrictions may apply. Products and restrictions are subject to change.