Tap into the hidden benefits of AP automation

6 minute read

The path to accounts payable (AP) automation starts with determining whether it’s right for the long- and short-term goals of your business. The next step is building a winning business case and setting measurable goals. (For more insight, see the first two articles in this series, Five steps to assess if AP automation is right for you and Five steps for building your AP automation business case.) But beyond the core benefits of efficiency, security and revenue generation, other, less obvious ways that AP automation can help are emerging. This article focuses on some of these intangible benefits that can enhance value, both internally and externally.

Unlocking supplier value

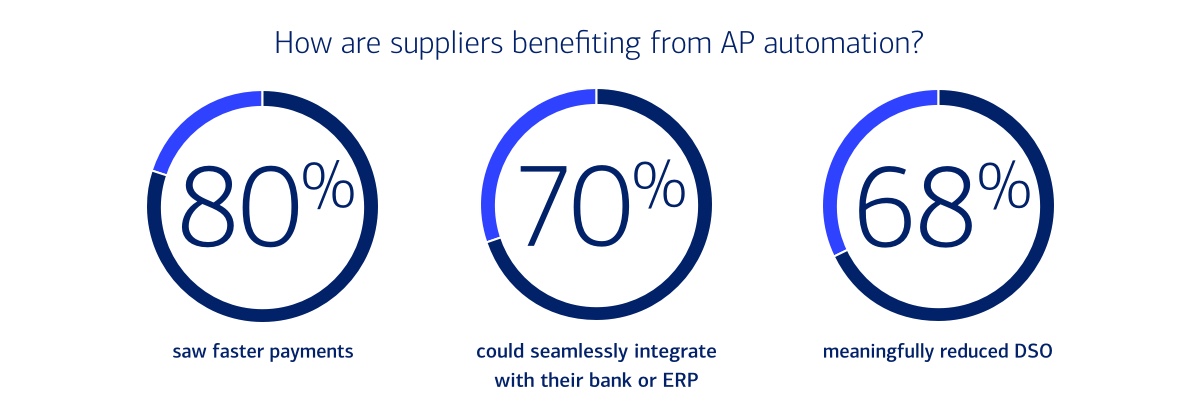

Automation brings improvements to the relationship between a company and its suppliers, with 80% of suppliers benefiting from faster payments and 68% reducing days sales outstanding (DSO), not to mention reduced exposure to fraud. But it can also unlock additional, hidden benefits that strengthen connections. To optimize your own supplier relationships, it helps to consider what kinds of companies you deal with — including size and complexity — what’s driving any resistance to automation and what success will look like to them. Then you can define a broad payment strategy for each segment.

For example, a large nationwide health care supplier might benefit from standardized payments, improved posting rates and reduced DSO. A mid-sized HVAC supplier may value faster availability of funds via card and ACH and the ability to redirect time to revenue generative tasks. Meanwhile, a small regional garage-door repair company may prioritize faster payments via digital payment networks, consistent remit information and reduced reliance on checks. Your approach can allow suppliers to reduce their payments “noise” and build processes that are positive for ROI. Working together can help build value for both parties.

Source: Bottomline 2024 vendor survey.

Businesses want an embedded experience

Businesses want access to the same type of instant digital payment solutions that have revolutionized the consumer side, but their existing payments structure often involves manual processes and fragmented systems that don’t work well together. Removing those and replacing with another system can take money and time, something that’s in short supply for many companies. That’s why it’s important to find an automated AP system that can work with and complement existing ERP systems, creating connectivity without a huge outlay. We’re now seeing a movement toward embedded B2B payments, driven by the consumer experience, that let companies initiate and manage payments from within their own platforms. Applying this to AP can help enable a more seamless process, where everything happens within one system and on one platform, streamlining operations and boosting efficiency.

The global embedded B2B payments market is projected to reach $16 trillion by 2030, up from $4 trillion today.

Source: Embedded B2B payments — Unlocking the $16 Trillion Opportunity with a 5-stepAction Plan, March 2025, Edgar Dunn & Company.

Automation can help with employee retention

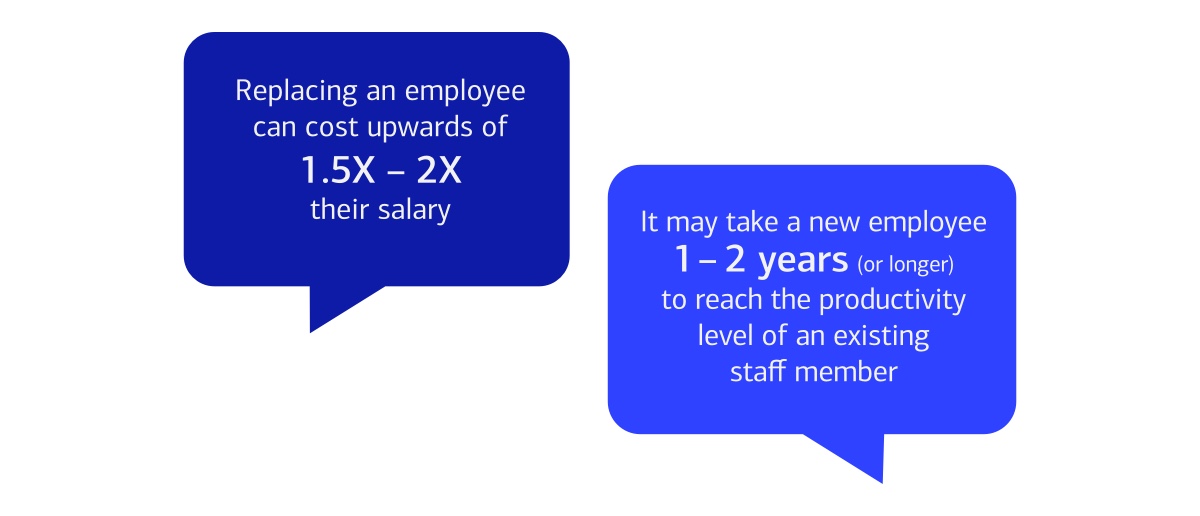

As more of the workforce is drawn from generations who have grown up in a digital-first world, there’s less appetite for manual and paper-based processes. Manual data entry can be frustrating and time-consuming, and easily preventable fraud attempts can sap morale. The end result can be costly turnover, and expenses related to recruiting, interviewing, IT provision and training can mount up. Not to mention project delays, disrupted customer or internal relationships and lower employee engagement. Additionally, the departure of experienced employees often results in a loss of institutional knowledge, putting your business at risk of not meeting its longer-term goals.

By incorporating automation into AP processes, companies can demonstrate to current and prospective employees that they are investing in their future. Reducing mundane tasks allows the company to reallocate resources to more meaningful and strategic projects, increasing job satisfaction, helping employees to grow their skill set, enhancing efficiency and reducing operational costs.

Source: Gallup Workplace Report, 2024.

Benefit from automation’s continued evolution

The old adage, “If it ain’t broke, don’t fix it” can be fine for maintaining the status quo, but it doesn’t help you keep up with — or move ahead of — the competition. AP solutions are evolving all the time, as is your business. Perhaps you’re growing fast, have gained a new client base or just want to meet shifting expectations of how payments should work. It’s always a good idea to revisit your current setup to see if there’s a small change that could make a difference. If you’ve already embraced automation but are finding areas where friction still exists, we can help put you on the right path.

You don’t have to do it alone

At Bank of America, we provide a comprehensive end-to-end AP approach, from invoicing to payments, and our technology investments offer mature, tangible solutions that keep up with your evolving needs. More importantly, we partner with you to make sure we understand your needs today and anticipate them for tomorrow, acting as an extension of your team.

Automation strategies and best practices in Accounts Payable

Accounts Payable (AP) automation can transform your business. This two-part series explores the journey from evaluating automation to unlocking hidden benefits, and highlights best practices for driving efficiency, resilience and strategic value in AP operations.