Five steps to assess if AP automation is right for you

Accounts Payable (AP) automation gives businesses the tools to be more effective, now and in the future. But automation isn’t just about modernizing, it’s about transforming a cost center into a strategic advantage — helping to increase productivity, reduce expenditure and free up resources for revenue-generating projects. These five steps can help you take stock of your current position and determine if automation can improve your AP processes.

3 minute read

Source: AFP Payments Fraud and Control Survey Report, 2024.

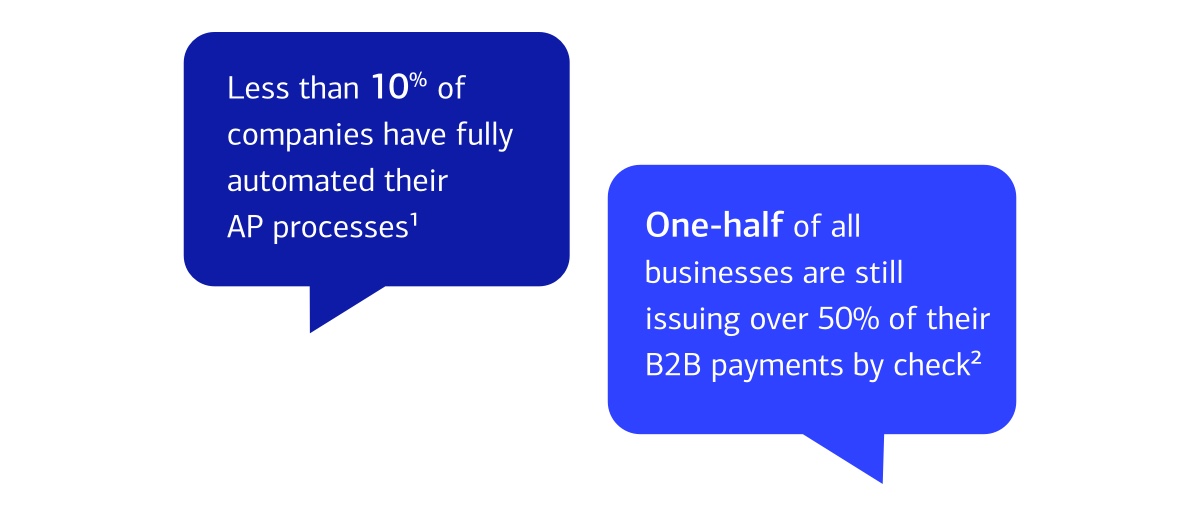

1 Gallup Workplace Report, 2024.

2 AFP Financial Operations Guide: Automating Accounts Payable Processing, 2024.

Prepare for the next step

The tasks highlighted here will help you determine whether automation can improve AP processes for your business. The next step will be devising a roadmap for getting started and building a business case that highlights the value of AP automation. But you don’t have to do this alone — Bank of America offers expert guidance and best-in-practice solutions that take a comprehensive approach to payments and AP.

Automation strategies and best practices in Accounts Payable

Accounts Payable (AP) automation can transform your business. This two-part series explores the journey from evaluating automation to unlocking hidden benefits, and highlights best practices for driving efficiency, resilience and strategic value in AP operations.