Segmenting, Selecting and Negotiating with Your Suppliers

Key takeaways

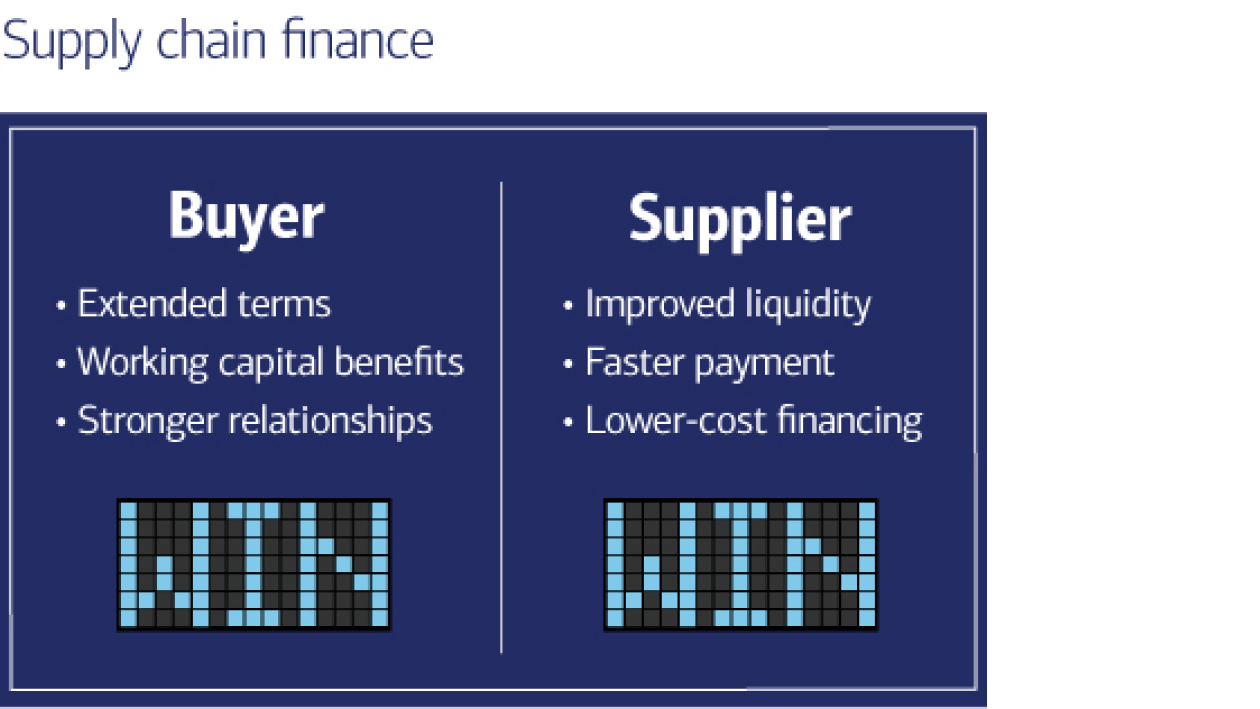

- Supply chain finance can facilitate terms extension and create a win-win for companies and suppliers

- Analyzing suppliers based on specific industry and company criteria is key to identifying strong candidates

- The right supply chain finance provider should help you assess, educate and onboard suppliers

In working with global companies across many industries, we have found that many frequently face similar hurdles when negotiating terms extension. Suppliers are often initially unwilling to accept a terms extension proposal because of liquidity needs, poor receivables turnover, and other financial issues. Some suppliers are resistant to terms extension if the proposed terms are well out of line with their own industry standard terms. In other situations, suppliers may be hesitant to extend credit terms to a customer whom they do not believe to be a creditworthy entity.

Companies often utilize supply chain finance (SCF) as a tool to bridge the gap between their own organization’s working capital goals and their suppliers’. An important first step, prior to leveraging SCF as a working capital tool, is to work with your supply chain finance provider to assess your working capital targets and select suppliers who are ideal candidates for payment terms extension. This can help minimize friction that may be caused between your organization and its key suppliers.

Supplier selection and segmentation

To provide your treasury and procurement teams a complete picture of your supply chain, Bank of America leverages industry insights derived from years of market experience combined with publicly available data sources.

Utilizing the analysis, we will work with you in a team effort to identify appropriate payment strategies based on likelihood of adoption, and how to best leverage supply chain finance to bridge the working capital needs between you and your supplier.

In Bank of America’s experience, we have found higher adoption rates with strategic suppliers whose current payment terms with our client fall below their overall current days sales outstanding, and suppliers who already participate in supply chain finance or card programs. These are key indicators that the suppliers value working capital improvement themselves.

Using our insights, we will evaluate your organization within the context of your industry, to help you benchmark against your peers and determine appropriate payment term targets to achieve success. Some questions that Bank of America can help you answer include:

- What is standard for your own industry?

- Are your terms more or less favorable compared to competitors?

- Is my cash to cash cycle slower or faster compared to my peers? Industry?

- What payment trends are occurring in your relevant market or industry within each region?

Suppliers are segmented and evaluated for the following criteria, using actual and estimated data points:

- Industry type

- Industry standard payment terms

- Regional standard payment terms (e.g., China vs. Mexico)

- Credit profile

- Company size

- Level of spend

- Receivables turnover or days sales outstanding (DSO)

- Current utilization of working capital tools such as card or supply chain finance

Negotiating terms extension using SCF as a negotiating tool

To support the negotiation with your suppliers, Bank of America can help educate your procurement team on the benefits of supply chain finance to your suppliers, and help alleviate concerns related to the terms extension. Our dedicated onboarding team can assist in pitching the benefits of supply chain finance to suppliers who may otherwise be unfamiliar with the program. This includes marketing materials and resources that communicate the benefits, such as improved liquidity through early payment, off-balance-sheet treatment through true-sale of receivables, and reduced financing costs. It is important to note that the finance provider is not involved in negotiating commercial terms.

When presented as a cost-effective, third-party financing option, an SCF program is often viewed by the supplier as an attractive alternative solution to finance their receivables. An SCF program can free up cash-flow for the supplier for other uses (pay down debt, reinvest, etc.). It is especially valuable to those suppliers who currently have a difficult or costly time financing existing or longer term and (possible) larger receivables balances.

It is important to highlight to the supplier the implied cost to holding receivables and waiting to get paid—the cost of both their debt and the opportunity cost of having equity and debt in the business to support those receivables, rather than invested in other assets. Pointing out the benefit created by using SCF (lowering the amount of debt or/and equity needed) and the related cost reductions is most often best handled by the SCF provider, such as Bank of America, rather than the buyer.

"In general, a SCF program can help all suppliers where the cost of the SCF program is lower than the debt and equity costs associated with holding receivable balances."

In addition, when a supplier has limited current borrowing capacity or equity, an SCF program can free up funds to support other needs.

Some suppliers do not feel they need additional financing options, and therefore are not interested in SCF, no matter how it is presented. They may have very low financing costs, or significant excess capacity to borrow/use cash.

Many, however, if presented with SCF as a financing option, rather than as part of the term extension discussion, will look much more closely at the benefits of the financing option as well, rather than focus solely on the costs of the term extension.

Best practices show that while negotiating with the supplier, separating the commercial negotiations (of longer payment terms, or better pricing, for example) from the financing option benefit that is being offered (an alternative financing option that may save the supplier costs) helps the supplier understand the total value proposition.

Conclusion

Working together, we can provide valuable insights and support, including financing options for suppliers, to move buyers and suppliers to industry standard terms, to ensure both are competitive in their respective markets.

Your Bank of America team has valuable insights for both buyer and supplier industry trends that can assist your organization in formulating the best strategy for you and your suppliers. Together, we can work to create a true “win-win” scenario.

Authors

Kaylee Karumanchi, Vice President, Global Trade and Supply Chain Finance, Bank of America