Bank of America N.A. Jakarta Branch | PT Merrill Lynch Sekuritas Indonesia

Translate: Bahasa

PT Merrill Lynch Sekuritas Indonesia (“the Company”) was established in Jakarta within the framework of the Foreign Capital Investment Law No. 1 year 1967 based on Deed No. 4 dated 5 December 1994 of Harvey T. Sondak, SH, notary in Jakarta.

On 1 January 2009, Merrill Lynch & Co., Inc., (“ML”) the former parent of the Company was acquired by Bank of America Corporation (“BAC”) and as a result, ML continued as a surviving company and became a subsidiary of BAC, until ML was merged with and into BAC on 13 September 2013. Therefore, BAC is the ultimate parent of the Company.

In accordance with article 3 of the Company’s Articles of Association, the scope of its activities is to engage mainly as the securities underwriter.

In its decision letter No. KEP-01/PM/PEE/1996 dated 8 January 1996, the Indonesian Capital Market Supervisory Agency (Bapepam), now Financial Service Authority (OJK), granted the Company a license as underwriter.

The Company’s office is located at Sequis Tower Level 25, Jl. Jend. Sudirman Kav. 71, SCBD (Sudirman Central Business District) Lot 11B Jakarta 12190, Indonesia, (T)+6221.29553888, (F)+6221.29553877

As at 30 June 2025, the members of the Company's Boards of Commissioners and Directors are as follows:

Commissioners: Leo Puay Wee and Anand Jain

Independent Commissioner: Gyanesh Chandra Nigam

President Director: Samuel D. Resowijoyo

Directors : Prijadi and Hartiani Rahayu

Leo Puay Wee, Commissioner

As Business Manager in COO for Singapore and South East Asia, Mr. Leo is responsible for supporting the Day-to-Day operations of BofA entities in Singapore, Malaysia, Indonesia, Thailand, and the Philippines. He is also a Board member of Merrill Lynch Securities (Thailand) Ltd., as well as a Board member of GHS Singapore Holding Pte. Ltd.

Mr. Leo joined BofA in 1995, and has held various roles in COO, Global Research, and Technology.

Mr. Leo is a Chartered Financial Analyst (CFA) and has a degree in Information Technology from Curtin University of Technology.

Anand Jain, Commissioner

Mr. Anand is South East Asia CFO for Bank of America. As a CFO, he is responsible for the management of the Finance function in Singapore, Malaysia, Indonesia, Thailand, and the Philippines, and supporting the country leadership team in monitoring of financial performance of the businesses in these countries. As part of this overall responsibilities, Mr. Anand is also responsible to ensure robust internal control framework for financial and regulatory reporting for Bank of America entities in South East Asia.

Mr. Anand joined Bank of America in 2007 and has worked in India, Hong Kong and Singapore.

Mr. Anand is a commerce graduate.

Gyanesh Chandra Nigam, Independent Commissioner

Mr. Nigam is an Independent Commissioner for PT Merrill Lynch Sekuritas Indonesia. As an Independent Commissioner, Mr. Nigam is responsible to ensure robust internal control framework and independently oversee the effectiveness of control functions (risk management, compliance, and internal audit functions) at PT Merrill Lynch Sekuritas Indonesia. As part of Board of Commissioners, Mr. Nigam carries supervisory duties, directs, monitors, and evaluates the implementation of Company’s strategic policy.

Prior to PT Merrill Lynch Sekuritas Indonesia, Mr. Nigam worked with Bank of America for 25 years before getting retired in 2019. He held various roles across Finance and Controllers at Bank of America. Prior to Bank of America, he has worked with HSBC in India.

Mr. Nigam holds a Master of Business Administration (MBA) from the India Institute of Management Ahmedabad (1986).

Samuel Darmawan Resowijoyo, President Director

Indonesian citizen, graduated from University of Oregon majored in Economics in 1991. He commenced his career with PT. Asia Equity Jasereh in 1994, and as Head of Dealing of PT Merrill Lynch Sekuritas Indonesia before moved to PT. BNP Paribas Securities Indonesia. In 2012, he moved back again to PT Merrill Lynch Sekuritas Indonesia as the Head of Risk Management function and appointed as the President Director since December 2016.

Prijadi, Director

Indonesian citizen, Director of the Company since 2011. Graduated from STIE YAI in 1995 majored in accounting and started his career at Joseph Susilo & Rekan Public Accountant Firm in 1995 before moved to Deloitte Tax Solution in 1997. Joined PT Merrill Lynch Sekuritas Indonesia in 1997 as Finance Manager before being appointed as a Director of the Company.

Hartiani Rahayu, Director

Indonesian citizen, graduated from University of Indonesia with bachelor degree majoring Accounting. Commenced her career as transfer pricing analyst at MUC Consulting group in 2010. In 2011, she started her career in capital market industry as Staff of Exchange Member Compliance Division at Indonesia Stock Exchange. In 2014, she moved to PT Danareksa Sekuritas (now: PT BRIDanareksa Sekuritas) with the last position as Audit unit head. Continuing her career in capital market, in 2019, she moved to PT Macquarie Sekuritas Indonesia before joining PT Merrill Lynch Sekuritas Indonesia in 2021. She was appointed as a Director of the Company in November 2021.

Notice:

PT Merrill Lynch Sekuritas Indonesia does not facilitate securities repurchase agreement (Repo) transaction

Objective

To provide service and complaints resolution in the financial services sector.

Procedure Details on Receiving Complaint

Customer Complaint and Reporting Services

For customer complaint and reporting on breach, please contact:

Complaint Service Team

Tel : +6221.29553888

Fax : +6221.29553877

Email DG MLINDO Complaint Service Team:

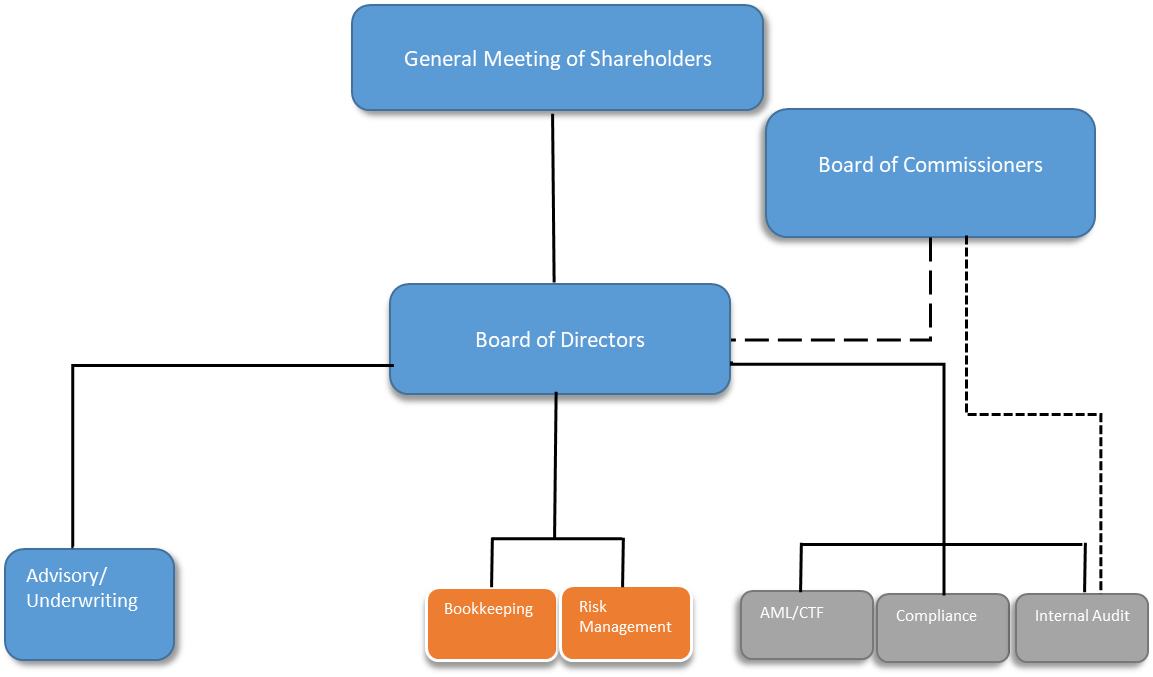

Terms of Reference Board of Commissioners and Board of Directors

For the implementation of internal control in accordance with Otoritas Jasa Keuangan rule No. 57/POJK.04/2017, the Company established the function of Risk Management, Compliance and Internal Audit as follows:

The implementation of risk management function of the Company shall at least cover:

The implementation of compliance function of the Company shall at least cover:

The implementation of internal audit function of the Company shall at least cover:

Enterprise Risk Management Framework of Bank of America Corporation

Summary of the Circular Resolutions of The Shareholders of PT Merrill Lynch Sekuritas Indonesia In Lieu of The Annual General Meeting of Shareholders

The Circular Resolutions, dated 16 June 2025, of the Shareholders of PT Merrill Lynch Sekuritas Indonesia adopted in Lieu of the Annual General Meeting of Shareholders resolved the following matters:

PT Merrill Lynch Sekuritas Indonesia – Audited Financial Report as of 31 December 2024

PT Merrill Lynch Sekuritas Indonesia – Audited Financial Report as of 31 December 2023

PT Merrill Lynch Sekuritas Indonesia – Audited Financial Report as of 31 December 2022

PT Merrill Lynch Sekuritas Indonesia – Audited Financial Report as of 31 December 2021

PT Merrill Lynch Sekuritas Indonesia – Audited Financial Report as of 31 December 2020

PT Merrill Lynch Sekuritas Indonesia – Audited Financial Report as of 31 December 2019

PT Merrill Lynch Indonesia – Audited Financial Report as of 31 December 2018

PT Merrill Lynch Indonesia – Audited Financial Report as of 31 December 2017

PT Merrill Lynch Indonesia – Audited Financial Report as of 31 December 2016

NOTICE

P T Merrill Lynch Sekuritas Indonesia is registered and supervised by the Financial Service Authority of Indonesia