Managing cash balances globally

Agile multinational corporations are always looking for ways to make their cash balances as flexible as possible. While U.S. interest rates remain elevated, taking a fresh look at liquidity and FX strategies — and how automation can help — becomes even more important to meet operating, investment and strategic needs.

7 minute read

Key takeaways:

- Proactively managing global cash balances can help drive long-term growth and stability.

- A successful approach includes managing risk more effectively, optimizing treasury systems and harnessing automation.

- Capital allocation strategies like physical cash concentration, notional pooling and intercompany netting can improve visibility and control.

Closer scrutiny across the entire organization could reveal the need to rationalize nonoperating currencies. This may increase earnings on consolidated positions, drive cost savings and free up time and resources within treasury operations. Evaluating capital needs can also help modify or implement structures that increase access to working capital. Additionally, optimizing liquidity, both domestically and across regions, reduces the need to borrow at higher rates and improves return on capital.

Find the right approach

Strategies for better managing global cash start with risk management, optimizing capital allocation and making the most of automation. But there’s no “one-size-fits-all” solution. It depends on your own specific requirements, such as:

- The ability to move funding across the organization and capital structure.

- Your existing systems and treasury infrastructure.

- Country or currency restrictions.

- Local banking regulations, which may limit visibility or control.

- Longer term or strategic cash needs.

Manage risk

Whatever your needs, effectively managing risk is key — there are three main types to consider:

- Principal risk arises from monetary, political or economic considerations. Ways to manage this include minimizing balances in particular countries or currencies, ensuring each part of the business is settling intercompany activity on a timely basis, and keeping a close eye on counterparties.

- FX risk mitigation could mean maintaining the balances you need to operate and eliminating excess funds in non-functional currencies. To achieve this, consider setting up a program to manage the balance sheet risk of non-functional currencies across the organization. You could also stress test foreign currency holdings to better understand the potential impact of currency movements.

- Interest rate risk means you need oversight over the rates paid on the different currencies you hold. You can adjust holdings to take advantage of differences in interest rates or to better offset assets and liabilities.

Harness automation

Optimizing your treasury systems is an important part of managing global cash. Automating your enterprise resource planning (ERP) and treasury management systems (TMS) can result in centralized databases that help manage workflows, streamline decision making and enhance operations. Strong banking partnerships are also important: banking partners can provide visibility across financial institutions via multi-bank reporting services, helping to find solutions that optimize liquidity and manage interest rate and FX considerations.

Reducing manual processes is a key part of cash consolidation. Leveraging multi-bank reporting via TMS or banking systems can help, as can setting up intelligent sweeps into and out of accounts. This can be as simple as defining target balances and transfer thresholds. You can also set target balances for operating purposes and sweep excess funds into other investment alternatives.

Choose a cash optimization strategy

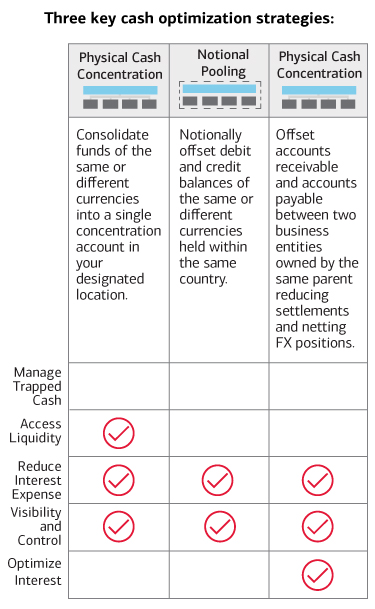

Cash optimization solutions can provide real-time visibility and insight into cash positions. They offer an easy path to automation and allow you to manage liquidity across currencies, as well as offering a flexible source of working capital. The three most common approaches are: physical cash concentration, notional pooling and intercompany netting. Each one has advantages and considerations — by evaluating your requirements, you can determine which approach is right for you.

Physical cash concentration

Physical cash concentration is perhaps the most widely used strategy, helping treasurers put all available funds to work while still maintaining visibility and control over cash balances. Multiple cash accounts are consolidated into concentrated pools, creating a header entity that offsets deficits in some business units by using funds from units with surpluses. Participants maintain their own accounts, and day-to-day banking is conducted as usual. Additionally, physical cash concentration can embed an automated FX component between currencies at transparent, fixed conversion rates.

Its key advantages are that it simplifies treasury management processes, which helps header entities make better investment decisions and leverage balances to drive better yields. It can also reduce the number of bank accounts needed globally, plus it can move balances within the same country or across borders, offering the flexibility to generate liquidity in different markets.

One thing to bear in mind is that third-party banking relationships, taking the form of an automated link to another institution, may be required in certain situations. This can be done either regionally or globally, for single currencies or on a cross-currency basis.

Notional pooling

Notional pooling is similar to physical cash concentration and helps to better leverage existing internal balances. It optimizes cash by consolidating the balances of multiple accounts, often in different currencies, without physically moving funds. Instead, notional pooling tracks the balance and calculates interest or charges based on the net positions of all accounts in the pool.

By offsetting debit balances in one part of the business with credit balances elsewhere, you can minimize borrowing costs and maximize returns on net credit positions. There’s no commingling of funds, and individual account positions are maintained. Notional pooling is particularly useful for global businesses that operate in various currencies. It allows you to take a regional approach or repatriate liquidity using a “follow the sun” approach, where pooling solutions are linked across regions. Funds in one currency offset the deficit in another currency, reducing FX costs and interest expense across the organization. However, notional pooling is considered a short-term instrument and will need to be renewed or restructured if funding is to be more permanent.

Intercompany netting

This approach offsets accounts receivable and accounts payable between two business entities within the same company, bringing intercompany invoice settlement into a single transaction in the parent company’s home currency. This net amount is received into and paid out from a central netting center, which can reduce both cost and FX risk. Intercompany netting can also help centralize the invoice review or dispute process, create discipline around intercompany settlement and force participants to settle on a timely basis.

Your path to long-term growth

In today’s rapidly changing environment, effectively managing global cash balances can help drive long-term growth and stability — and create a competitive edge. It can offer access to liquidity that may otherwise have been lost, helping you to redeploy cash, optimize returns on working capital and reduce borrowing costs. Whichever path you choose, making your global cash work for you can help take your business to the next stage of success. To find out more about cash consolidation, automation and other approaches, contact your Bank of America representative.

Adam Glassman | Managing Director, Treasury Product Executive, Bank of America

Sebastian Sintes | Director, Treasury Product Sales Manager | Bank of America

Global FX Solutions

Our innovative solutions offer an easy way to streamline workflows — saving time and cost and making FX faster, simpler and more secure.