Hiring and retaining employees continues to be a major challenge for restaurants. It takes over a month and costs thousands of dollars to replace one employee. Owners, therefore, need to think creatively about how to differentiate their workplace to attract the best new hires and motivate them to stay. In this Q&A, John Quinn, head of Workplace Benefits Product and Platform Management for Bank of America, and Aliya Willis, senior relationship manager for Global Commercial Banking at Bank of America, offer insights on the wide range of benefit options restaurant owners may want to consider to help build a motivated, engaged workforce.

What can employers do to meet employee needs while also managing their bottom line?

John Quinn: Restaurant owners have adjusted by increasing wages for their workers, but they have to be able to offer more than better base pay to stay competitive. Adding benefits to the employment package promotes greater employee satisfaction so people want to come to work and are more likely to stay. Restaurants operate on thin margins, so the considerable expense of having to hire and train new staff due to high employee turnover is a major drain on profits. A restaurateur needs to evaluate whether their benefit package is attractive enough to retain employees. Even if those benefits introduce some incremental day-to-day operating expenses, the reduction in employee churn rates can give owners a very compelling and financially beneficial reason to invest in benefits for their employees.

What types of benefits would help attract and retain entry-level restaurant employees, who are among the youngest workers?

Willis: If you want your employees to care about what’s important to you, you have to show that you care about what’s important to them. One way to demonstrate that you understand your employees’ needs is to offer a lifestyle spending account (LSA). An employer puts dollars into an account for each employee to spend on a customized selection of items or activities (the money is taxable just like salary and appears on the employee’s W-2). Restaurateurs can limit employees’ use of those dollars for a specific purpose, or they can leave the program open and allow employees to use those dollars for anything they feel is important to them.

LSAs can be a way to incentivize a workforce that often logs long hours under stressful conditions by letting workers pursue things like wellness activities. An LSA might be targeted to pay for gym memberships, yoga classes or weight-loss programs. Or, if getting employees to stay with the company is challenging, the promise of an LSA contribution after six months may be a way to encourage a longer tenure. Or employees can earn funds if they complete training modules.

Often younger employees aren’t fully aware of how to use their benefits to their advantage. How do you solve that problem?

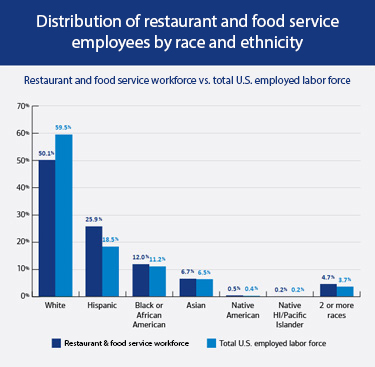

Willis: It’s critically important to pair a retirement plan with a comprehensive financial education program. If you can help your employees learn how to budget their money, they can feel more confident in putting some of their discretionary income into retirement savings. As a financial partner, Bank of America has programs like Better Money Habits®, for example, that provide a basic financial education to improve the financial lives of employees, with guidance on budgeting, cash management, the importance of saving money and how to invest. The restaurant industry has a workforce that comes from a diverse array of backgrounds and levels of affluence, and some employees may not have a checking account, which means they are charged fees when they cash their paychecks. Better Money Habits shows them how to open a checking account to avoid those fees and how to sign up for savings accounts so they can start saving.