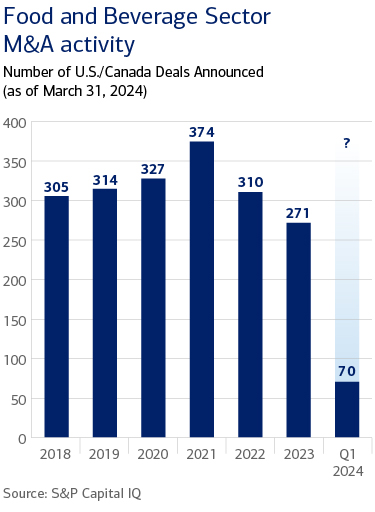

The last five years have been an unpredictable period to be in the restaurant industry, culminating in what forecasters believe to be a significant resurgence in M&A activity for 2024 and 2025. This period started with Covid which changed the restaurant sector forever. Across formats, restaurateurs changed the way they did business and consumers adapted too, underscoring the important role that restaurants play in delivering variety and convenience.

Restaurant M&A outlook for 2024 and 2025

The last five years have been an unpredictable period in the restaurant industry, leading to a forecasted surge in M&A activity for 2024 and 2025

9 minute read

Owners and operators pivoted to focus on takeout and delivery, a service model that is now part of the new business as usual. Early M&A activity was focused on “Covid-proof” QSRs (i.e., those with drive-thrus) with a number of high-profile transactions during 2021. Just as we thought the restaurant industry was starting to normalize in 2022, supply chains became challenged, food inflationary costs rose dramatically, and the Federal Reserve rapidly raised interest rates while sale numbers remained much lower than in pre-Covid times. In this backdrop, M&A activity slowed materially, and buyers and sellers looked for signs of stability which we are now seeing materialize in 2024.

In the QSR space, restaurateurs who saw demand accelerate and feel like they missed their opportunity in 2021, are starting to explore still robust strategic and financial interest in the sector. Restaurateurs in full service who strengthened their business through Covid and the subsequent period of inflation are ready to start looking at their exit options as well.

New Outlook in 2024

Earlier this year, Federal Reserve officials said they expect the U.S. central bank to cut interest rates three times in 2024, but with continued rising inflation, it’s still not clear what’s going to happen. Now may not be the time to refinance; however, it’s a prime opportunity for mergers and acquisitions, which are expected to boom.

“I’m very bullish on the fourth quarter of 2024 and 2025,” says Edward “Ted” Lynch, managing director in Bank of America’s Global Commercial Banking’s Restaurant Group. “I think 2025 will be an extremely busy year for M&A deals.”

Amy Forrestal, longtime managing director of Brookwood Associates (an Atlanta-based investment bank) agrees. Brookwood already closed one deal in the lower-middle market back in late February and has two additional deals scheduled to close in early summer, with “lots of inquiries and lots of pitching” already happening this year. “It’s as robust as it was in 2016-17,” she added.

John Hamburger, publisher of the Restaurant Finance Monitor, has gone through several up-and-down cycles in the market during his long tenure in the industry, including the Great Recession in 2007-2009. Hamburger says he’s prone to looking for the other shoe to drop, and yet, “there are still a lot of reasons to be a buyer” for companies that are looking to grow or branch into another concept.

While the motivation behind buyers includes economies of scale and growth, sellers’ reasons cover the spectrum. Some founders are ready to retire or have taken the concept as far as they want to or can with their existing team. Other operators are seeing the writing on the wall with slowing traffic counts as consumers largely migrated to dine-out or food delivery because of higher prices. With higher interest rates, the absence of government stimulus money and general fatigue, finding the right buyer looks like a lifeline.

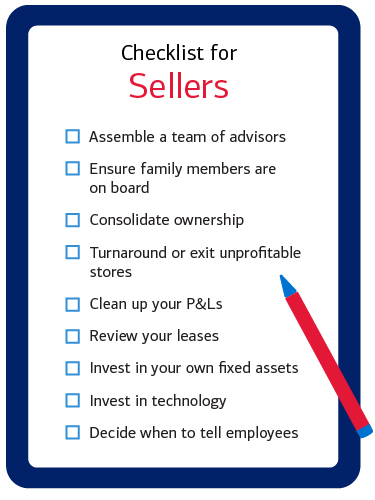

What Sellers Need to Know

If you are in the day-to-day trenches of running your business, getting ready for a sale is akin to taking on a second job. Higher interest rates can mean lower prices for sellers, but strong concepts are always in demand. That said, it helps to be realistic in what your company can sell for.

“Scale matters,” says Richard Peacock, managing director in BofA Securities’ Global Corporate & Investment Banking group. “It’s hard to sit in the middle with rising operating costs; larger players have greater negotiating leverage and can invest in capabilities, technology and talent.”

Smaller deals, such as a recent 20-unit QSR franchisee, are getting done, as well as large deals. The Flynn Group’s acquisition of Pizza Hut Australia and Planet Fitness franchisee Alder Partners was one of Franchise Times top 10 deals for the May 2024 issue.

“While there is interest across the sector, Peacock explains, “we have seen especially strong demand for franchisors which tend to trade at higher multiples as they are asset light and somewhat insulated from the wage and food cost inflation that we’ve seen impact operators. That said, best-in-class operators which often have regional or national scale, are also seeing interest as they can differentiate with higher traffic, comps and margins.”

Here are some things you can do to make your deal attractive, regardless of your size.

- Assemble a team of advisors, starting with bankers, attorneys, and accountants, all with significant M&A experience and tax expertise. You’ll need both legal and operational options on how to attract the right buyers.

- If you’re a family-owned business, ensure all family members involved are on board with selling the company. Many businesses have an emotional element when it comes to exiting, but none more so than those still owned by the founders or a family.

- Consolidate ownership so there are fewer players on the sell side.

- Look at each individual unit. If you have unprofitable stores that will affect the sales price, consider ways to turnaround or exit the location so you avoid the buyer capitalizing those loses into perpetuity.

- Ensure that your P&Ls are clean and that your records are in good shape to be as transparent as possible with prospective buyers. Be proactive about having the answers to any questions about your operations before a buyer has to ask. Using a national or strong regional accounting firm to assist with a Quality of Earnings study is often a critical step before a sale.

- Review your leases to see how much time remains on them and be proactive to make sure they are transferable.

- Invest in your own fixed assets and look for low-hanging fruit for expense reduction.

- Invest in technology that will both streamline your operations and address labor shortages. According to the International Franchise Association’s article, Unveiling 2024 Franchising Trends in the United States, “In the tech-savvy landscape of 2024, the integration of technology has become a cornerstone of franchise success in the United States.”

- Determine the appropriate time to tell management and employees that the company is for sale, and consider incentive offers to retain good employees.

“Employees may get mad if they’re not told, but they may leave if they know,” Hamburger says. “It’s a delicate issue.” Another downside is that if you tell employees and then the deal doesn’t get done, you could lose some of your best performers. Putting in the right incentives for key team members is critical.

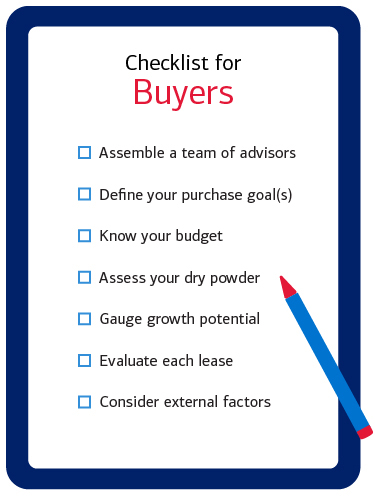

Tips for Buyers

The great news is, there’s adequate capital out there, but investors are realizing that due to the uncertainty of the recent past, quick turnarounds may not be possible right now. While veteran restaurateurs have seen high inflationary times previously, for many newer operators, this is unfamiliar territory, and it’s important to take the time to understand the current market and do some pre-work when looking to buy.

Here are some things for buyers to consider and do to prepare for a purchase:

- Like sellers, buyers should start by talking with experienced M&A bankers, attorneys, and accountants for their expertise to get a historical perspective and to get tax expertise. Additionally, by getting started with them early, you will be able to move more quickly once you uncover the right deal.

- Have a clear picture of what you want to accomplish by purchasing a company. Define the short-term and long-term advantages.

- Go in knowing what you can afford to pay and how you’re going to finance it.

- Evaluate and/or grow your available cash and dry powder (highly liquid securities with low risk that can quickly be converted to cash if needed).

- If national or international expansion is your game plan, be sure the concepts you’re looking at have the legs to travel beyond local or regional chains. For larger chains, be sure there are still expansion opportunities and an appetite outside the brand’s current core area.

- When evaluating a deal, look at each lease to see if the rent makes sense, how much time remains and whether they’re transferable.

- Consider external factors like geography that can also affect a deal. Hamburger says he’s heard that franchisees in California are spooked by the $20 minimum wage, and there’s been some discussion on selling now. Higher salaries, health insurance benefits, sales, and other taxes, etc., in the operating state are all things to consider in evaluating what is the right deal for you.

For both buyers and sellers, the disruptions, constant adjustments and changing consumer behavior are slowly becoming more manageable as we move through 2024. The restaurant industry has learned to be nimble and flexible and to adjust as necessary. In its industry report for 2024, Technomic states, “Industry headwinds moderated over the past year, and 2024 promises the hope of a more predictable atmosphere relative to labor, inflation and supply.”

Look for more insights in October, as Bank of America releases its 2024 State of the Restaurant Industry report; and reach out to your relationship banker to discuss your 2024/2025 pipeline.