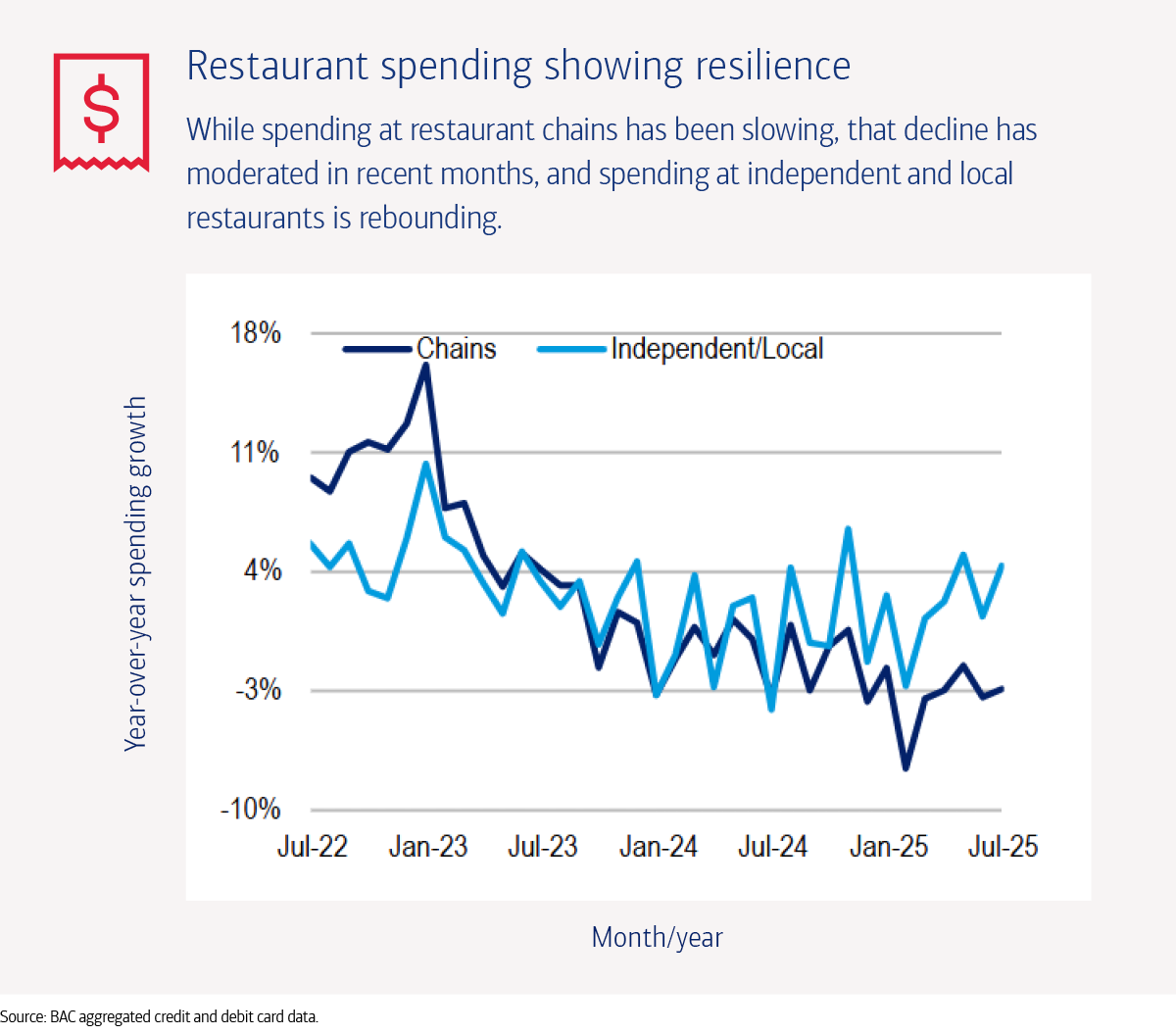

Restaurant spending showing resilience

While spending at restaurant chains has been slowing, that decline has moderated in recent months, and spending at independent and local restaurant is rebounding.

In January 2022, spending growth at chains was 2.9% and at local/independents it was 30.9%.

In February 2022, spending growth at chains was 18.3% and at local/independents it was 34.9%.

In March 2022, spending growth at chains was 7.8% and at local/independents it was 20.5%.

In April 2022, spending growth at chains was 9.8% and at local/independents it was 18.7%.

In May 2022, spending growth at chains was 9.0% and at local/independents it was 8.7%.

In June 2022, spending growth at chains was 9.3% and at local/independents it was 6.6%.

In July 2022, spending growth at chains was 9.5% and at local/independents it was 5.6%.

In August 2022, spending growth at chains was 8.7% and at local/independents it was 4.3%.

In September 2022, spending growth at chains was 11.1% and at local/independents it was 5.7%.

In October 2022, spending growth at chains was 11.6% and at local/independents it was 2.9%.

In November 2022, spending growth at chains was 2.9% and at local/independents it was 2.5%.

In December 2022, spending growth at chains was 12.7% and at local/independents it was 6%.

In January 2023, spending growth at chains was 16.2% and at local/independents it was 10.3%.

In February 2023, spending growth at chains was 7.7% and at local/independents it was 6%.

In March 2023, spending growth at chains was 8% and at local/independents it was 5.3%.

In April 2023, spending growth at chains was 4.9% and at local/independents it was 3.3%.

In May 2023, spending growth at chains was 3.1% and at local/independents it was 1.6%.

In June 2023, spending growth at chains was 5.1% and at local/independents it was 5.2%.

In July 2023, spending growth at chains was 4.1% % and at local/independents it was 3.4%.

In August 2023, spending growth at chains was 3.2% and at local/independents it was 2.0%.

In September 2023, spending growth at chains was 3.2% and at local/independents it was 3.4%.

In October 2023, spending growth at chains was minus 1.6% and at local/independents it was minus 0.3%

In November 2023, spending growth at chains was 1.6% and at local/independents it was 2.5%.

In December 2023, spending growth at chains was 1% and at local/independents it was 4.6%.

In January 2024, spending growth at chains was minus 3.2% and at local/independents it was minus 3.2%.

In February 2024, spending growth at chains was minus 1.1% and at local/independents it was minus 0.9%.

In March 2024, spending growth at chains was 0.7% and at local/independents it was 3.8%.

In April 2024, spending growth at chains was minus 0.9% and at local/independents it was minus 2.8%.

In May 2024, spending growth at chains was 1.2% and at local/independents it was 2.0%.

In June 2024, spending growth at chains was 0.1% and at local/independents it was 2.5%.

In July 2024, spending growth at chains was minus 3.4% and at local/independents it was minus 4.1%.

In August 2024, spending growth at chains was minus 3.4% and at local/independents it was minus 4.1%.

In September 2024, spending growth at chains was minus 3.4% and at local/independents it was minus 4.1%.

In October 2024, spending growth at chains was minus 3.4% and at local/independents it was minus 4.1%.

In November 2024, spending growth at chains was minus 3.4% and at local/independents it was minus 4.1%.

In December 2024, spending growth at chains was minus 3.4% and at local/independents it was minus 4.1%.

In January 2025, spending growth at chains was minus 1.7% and at local/independents it was minus 2.6%.

In February 2025, spending growth at chains was minus 7.5% and at local/independents it was minus 2.7%.

In March 2025, spending growth at chains was minus 3.5% and at local/independents it was 1.3%.

In April 2025, spending growth at chains was minus 3.0% and at local/independents it was 2.3%.

In May 2025, spending growth at chains was minus 1.5% and at local/independents it was 5.0%.

In June 2025, spending growth at chains was minus 3.4% and at local/independents it was minus 1.4%.

In July 2025, spending growth at chains was minus 2.9% and at local/independents it was 4.3%.

Source: BAC aggregated credit and debit card data.