How can banks navigate the evolution of cross-border payments?

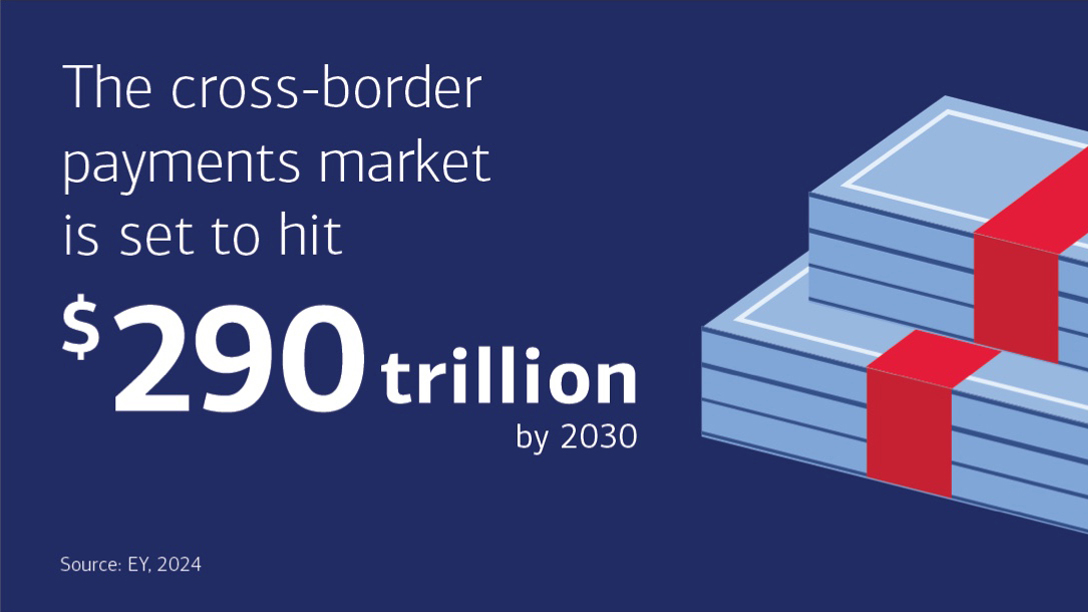

Banks are facing a competitive payments environment. While clients can move money fast and efficiently domestically, it’s a different story trying to transact across borders. With fintechs taking market share and a large-scale infrastructure transition underway, we highlight some key themes driving the evolution of cross border payments and how correspondent banks can regain the initiative.

9 minute read

Exploring the current environment

Domestic payment options have seen the greatest rate in innovation over the past three to five years, outpacing cross-border solutions. This is unsurprising when you consider the increased complexity of moving money globally, such as currency issues, regulation and legacy technology. Newer players like fintechs have jumped ahead with quicker product development while banks lag behind, reflecting banks’ wider responsibilities for policing financial crime, money laundering and more, issues that are top of mind for the industry. While fintechs have focused mainly on the peer-to-peer space, primarily delivering on remittances, banks have a larger remit. This opens opportunities not only in remittances but also in commercial activities, corporate investments, central bank settlements and capital markets.

A climate of rising expectations

With consumer payments becoming faster and easier, clients are demanding a similarly transparent, seamless and cost-effective way to move money across borders. Speed is key, and banks need to develop real-time, cross-border payments to stay in the game. The question is: How do we go from the world we have today, where it may take 24 hours to move a payment from, say, the U.S. to the U.K., to a one where you can do that in 15 seconds? That’s the real challenge, especially when you consider that banks will still have to maintain the same levels of control and monitoring. The price of sacrificing these elements could be reputational damage and regulatory fines. Banks also need to think about protecting their bottom line and revenue streams even as they try to meet expectations that include low fees.

Creating a better experience

Optimizing the user experience is another challenge, whether it’s a domestic or cross border transaction. From individuals to multinationals, clients are looking for connectivity benefits and security around moving anything from $100 to $10 billion — with the same user-friendly features they’re used to as consumers. Banks need to provide an enhanced experience across customer sectors, and getting creative can help.

Where will the industry be in five years?

Several factors need to evolve for banks to reimagine cross-border payments, and infrastructure moves could be a game changer. The ISO transition is ongoing, introducing a new standard for financial messages that enables interoperability between bank systems, market infrastructures and customers. November 2025 is a global milestone when Swiſt mandates that all banks fully change over to the ISO format. These big industry moves open up the possibility that banks will be able to conduct cross-border real-time payments. It could provide an opportunity to claw back some lost market share or at the very least regain an equal footing with non-bank competitors.

Updating legacy infrastructure

When the benefits from the ISO transition begin to be felt, we may see some real progress. However, it will also take significant investment by financial institutions to upgrade the legacy infrastructure that banks are working with. Many current systems were built for traditional correspondent banking and the speed by which payments have historically flowed throughout the payment ecosystem. But today, the banking industry needs to support new payment methods like digital wallets, alias-based payments, QR codes and real-time payments. Evolution in Swiſt and the data-rich messaging arising from ISO changes can help meet some of these expectations, including creating a common language, structure and rules. Banking governing bodies will also need to get involved to help develop a cross-industry solution.

The connectivity challenge

Today, payment ecosystems are oſten siloed across different countries. The way forward is interoperability, or the ability to work seamlessly outside your own network. This concept is quickly being embraced in the payments world. Initiatives such as SEPA Instant Credit Transfer and Project Nexus in the EU, and Zelle® in the U.S., are already boosting interoperability and speeding up global transactions. To evolve cross-border payments, banks need to move away from smaller, niche, closed-loop entities and focus on building something that is global, scalable and accessible.

The latest technology

As new technologies become available, banks will be able to make cross-currency transactions simpler and more transparent. Alternative payment options are key, including those with untapped potential such as Stablecoin. Bringing these into the ecosystem should result in new and interesting developments, allowing banks to enhance their offerings.

How can banks help?

With a global focus on enhancing cross-border payments, banks can take steps now to increase momentum. These include embracing emerging payment technologies, adapting to new, data-rich formats and supporting industrywide action. The next few years could be a time of opportunity for banks to provide accessible, seamless and cost effective solutions that move the industry forward. Engaging with the issue now can help our industry thrive in a rapidly changing payments world.

Eddy Almonte | Managing Director Head of North America Banks & Global USD Clearing Sales

Daniel Stanton | Managing Director, Treasury Product Executive

Zelle and the Zelle marks used herein are trademarks of Early Warning Services, LLC.

Global FX Solutions

Our innovative solutions offer an easy way to streamline workflows — saving time and cost and making FX faster, simpler and more secure.