Protecting your bottom line from chargebacks

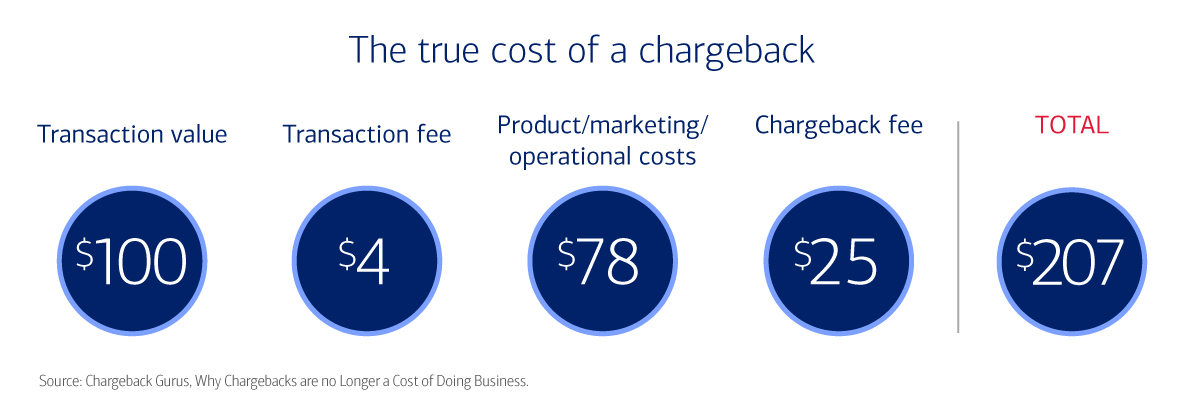

Global chargeback volume was estimated to reach $117 billion by the end of 20231, and chargebacks can pose a serious threat to your business. In addition to lost merchandise and increased overhead, the major card networks can charge higher fees and monthly fines if they feel your chargeback rates are too high. But challenging chargebacks can be expensive, labor-intensive and confusing. Having a prevention strategy — and processes in place for managing with them if they do happen — is key for protecting your revenue and reputation.

7 minute read

Key takeaways

- Chargebacks, many attributable to fraud, can mean hefty fees, lost merchandise and increased overhead.

- Taking steps to prevent them, such as making your billing descriptor easy to recognize, is the simplest way of protecting your business.

- The right processes and tools can help you successfully challenge chargebacks.

What’s driving chargebacks?

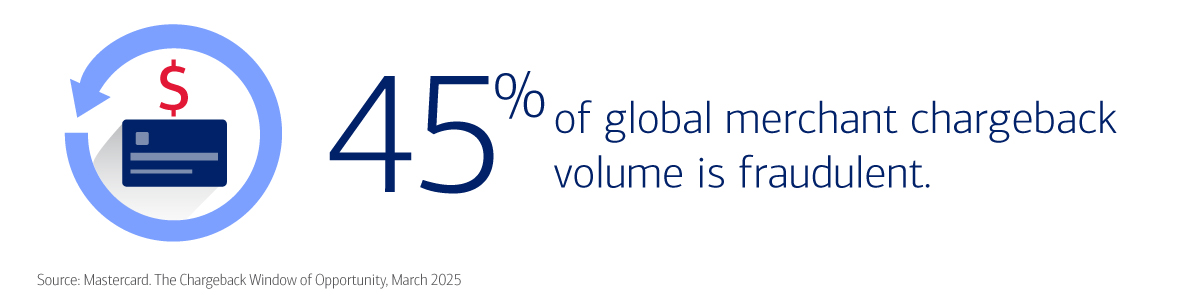

Many can be attributed to fraud — Mastercard believes that 45% of global merchant chargeback volume is fraudulent. Some of this is obvious criminal activity using stolen cards, but some is due to so-called “friendly fraud.” This is when a customer doesn’t recognize a charge, perhaps because they don’t remember the event. Or they may be using a chargeback as an alternative to engaging with customer service or a manager to get a refund.

How can you help prevent chargebacks?

Taking steps to stop chargebacks from occurring in the first place is the simplest way of protecting your business:

- Make your billing descriptor easy to recognize so customers won’t think it’s a fraudulent charge when they look at their statement.

- Ensure people know how to contact you. Put your customer service number, website and social media channels on receipts.

- Make cancellation/return information readily understandable and prominent, and communicate terms and conditions for services, using "Acknowledgment" checkboxes to ensure your customer sees them.

- Resolve client issues quickly before they can escalate into payments disputes.

- Comply with credit card brand rules and guidelines.

- Use all the payments tools at your disposal:

- Use standard cardholder information, available to everyone, to verify transactions.

- Verify any transaction that seems out of the ordinary or is over a preset amount.

- Treat chargebacks like any other fraud, looking for patterns and staying vigilant.

- Upgrade to the latest payments technology.

How can you win more disputes?

Despite your best efforts, chargebacks are going to slip through, but being prepared can help. Even if you don’t have a large, dedicated team, you can still educate your workforce. For example, employees can be trained to follow through on voids and refunds. And strengthening your customer service could pay off if it means customers will feel confident that you’ll listen if there’s a problem.

JP Park, Director - Transact, Fraud, Security, & Disputes Strategy, Merchant Services at Bank of America, believes that making it easier to contest chargebacks and boosting internal awareness of them could increase win rates. He says, “If companies have a combination of incentives and clear guidance, their efforts on challenging chargebacks might be rewarded.”

What’s the right approach for you?

One of the first things to consider is whether you’re going to fight every chargeback that comes through. Because of low win rates and the fees involved, it can sometimes make more sense to pick your battles. However, there is value in pursuing larger claims that you believe are errors or fraud. Big retailers tend to take this approach, letting smaller amounts go as the cost of doing business but contesting larger sales. Crucially, they respond within the time frames set by the card brands and use automated tools to collect and store information that can help them prove their case.

Park says, “The best thing to do is respond to chargebacks quickly with the appropriate documentation. Build a documentation trail that proves you did what you said you would.” For example, keep billing information, shipping confirmation and signatures so you can demonstrate that goods were delivered or services carried out.

Only the largest companies tend to build their own software, but tools that automate and standardize the chargeback process are essential for businesses of any size. Bank of America offers software for managing chargebacks and has solution partnerships with outside providers, helping to automate processes and allowing merchants to take action and directly submit dispute documents.

What’s next for chargebacks?

Many large corporations already use automated response tools matched with customer details, and this kind of automation based on intelligent actioning is where the industry is headed. JP Park comments, “Automation is key for any business in keeping their costs low when working their chargebacks. We’re seeing some interesting developments out there where rules engines do most of the heavy lifting, and operations efficiencies are found through a combination of artificial intelligence and robotics, which further reduces overall costs.”

Wherever the industry goes next, the best way to protect your business is to consider chargebacks at every stage of the customer journey — from preventing misconceptions when you make a sale, through to comprehensive record keeping and challenging the cases you think you can win.

Additional resources

- Best practices for retailers

- Best practices for restaurants

- Best practices for card-not-present transactions

1Source: Mastercard, 2025.

4 ways to improve your authorization rates

Card declines can cost merchants both sales and customers. Here are proven ways to reduce how often it happens