EuroFinance International Treasury Management

Conference attendees weighed in on important issues while also receiving a sweet treat – here’s what they told us.

Visitors to the Bank of America booth at EuroFinance International 2024 used colored candy to vote in daily polls. The results were captured on the Candy wall.

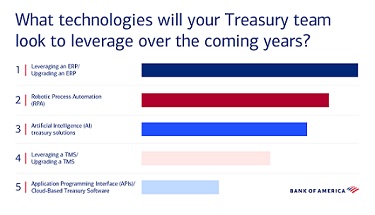

What technologies will your treasury team look to leverage over the coming years?

Day 1 results: #1 Leveraging an ERP/Upgrading an ERP, #2 Robotic Process Automation (RPA), #3 Artificial Intelligence (AI) treasury solutions, #4 Leveraging a TMS/Upgrading a TMS and #5 Application Programming Interface (APIs)/Cloud-Based Treasury Software

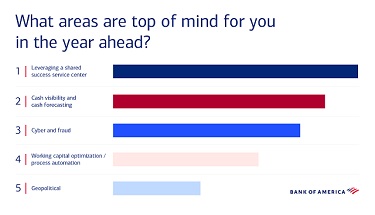

What areas are top of mind for you in the year ahead?

Day 2 results: #1 Leveraging a shared success service center, #2 Cash Visibility & Cash Forecasting, #3 Cyber & Fraud, #4 Working Capital Optimization/Process Automation and #5 Geopolitical.

“Every day, we process USD2 trillion in payments going to and from hundreds of countries in dozens of currencies. Our clients rely on this global reach and local expertise to stay informed about payment trends, to understand the local jurisdictions and to employ the latest digital solutions to grow their businesses.”

Matthew Davies | Managing Director, Head of GPS EMEA, Co-Head of GPS Global Corporate Sales, Global Payments Solutions, Bank of America

Related Content to EuroFinance International

Optimizing liquidity operations in a dynamic environment

Key considerations that treasurers should employ when managing liquidity.

Consolidating cash between regions

With rates sitting at a 20-year high with a forecast for gradual easing, companies continue to seek ways to optimize liquidity domestically and across regions, reduce borrowing costs and improve returns on capital.

The end of the line for the daily cash position?

Fixing the daily cash position used to be pivotal. But instant payments and receivables demand continual updates throughout the day.