The current landscape presents the opportunity to take a fresh look at liquidity and FX strategies. Greater scrutiny may reveal the need to rationalize nonoperating currencies, which could help you increase earnings on consolidated positions, drive cost savings and free up time and resources within treasury operations. Additionally, evaluating capital needs across regions may allow you to modify or implement structures that increase access to working capital, wherever and whenever it’s needed.

Consolidating cash between regions

With rates sitting at a 20-year high with a forecast for gradual easing, companies continue to seek ways to optimize liquidity domestically and across regions, reduce borrowing costs and improve returns on capital.

5 minute read

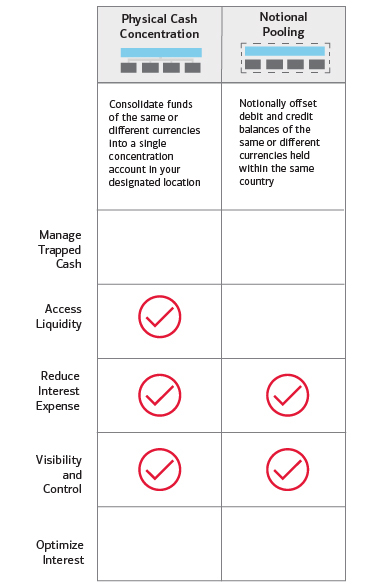

Two key ways to consolidate currencies

Effective automated solutions are available to help you manage liquidity across currencies, either singly or combined. These can provide real-time visibility and insight into cash positions, as well as offering a flexible source of working capital.

1. Physical Cash concentration

This automates transfers between accounts in a single jurisdiction or across regions, physically concentrating funds into a single account in a designated location. Additionally, it can embed an automated FX component between currencies at transparent, fixed conversion rates.

Benefits

- Moves balances within the same country or across borders, offering the flexibility to generate liquidity in different markets.

- Helps mitigate exposure to FX rate variations when transferring between two currencies.

- Simplifies treasury management processes.

- Enhances visibility and control.

Considerations:

Third-party banking relationships, taking the form of an automated link to another institution, may be required in certain situations. This can be done either regionally or globally, for single currencies or on a cross-currency basis to further achieve your consolidation goals.

2. Notional pooling

This is a short-term working capital tool that uses surplus balances to reduce reliance on short-term debt. It works by offsetting debit balances against credit balances of the same or different currencies held within the same country. There’s no commingling of funds, and individual account positions are maintained. It can be especially helpful for corporations that have decentralized operating structures with entities that want to preserve their autonomy.

Benefits

- Reduces the need to perform multiple FX transactions.

- Helps minimize borrowing costs and maximize returns on net credit positions.

- Streamlines multiple accounts across currencies.

- Allows you to take a regional approach or repatriate liquidity using a “follow the sun” approach, where pooling solutions are linked across regions.

- Links operating accounts to pooling accounts using physical cash concentration, if needed.

Considerations:

Notional pooling is allowed only in certain locations.

Do you need a multi-entity or single-entity structure?

For multi-entity structures, notional pooling reduces the need for intercompany transfers, as entities own and operate accounts in their own names.

Single-entity structures with intercompany transfers from operating accounts will be positioned for an On-Behalf-Of (OBO) structure or an In-House Bank (IHB) scenario, which can greatly reduce the number of accounts an organization holds.

Virtual accounts offer visibility and control

While you’re reevaluating your currency management, consider incorporating virtual accounts. These can be a healthy complement to either a physical account or a notional pooling structure, allowing you to cut the number of operating accounts and reduce associated costs and risks.

Benefits

- Improve transparency and streamline reconciliations for day-to-day transactions.

- Boost operational efficiencies.

- Reduce account administration.

Take the first step

Examining your current structures is a good first step toward getting the most out of automated liquidity solutions. Physical cash consolidation and notional pooling can offer access to liquidity that may otherwise have been lost, helping you to redeploy cash, optimize returns on working capital, reduce borrowing costs and potentially reduce individual FX transactions. To find out more about these and other approaches, contact your Bank of America representative.

Author: Matt Fletcher, Director, Global Liquidity Sales Manager

Optimizing liquidity operations in a dynamic environment

Key considerations that treasurers should employ when managing liquidity.