Kim Parfett, senior manager, accounts payable and treasury systems & processes at Chaucer, joined Adam King, treasury sales officer at Bank of America, and Jeff Pauly, treasury product sales manager at Bank of America, on a recent episode of the Treasury Insights podcast, to discuss how the insurance group transformed its reconciliation processes.

Advance your receivables reconciliation

Receivables reconciliation plays a key role in managing accurate financial statements — vital for making informed business and treasury decisions — while advanced tools, technology and automation allow treasurers to significantly enhance their process efficiency.

7 minute read

Key takeaways

- Advanced receivables tools allow treasurers to significantly enhance their process efficiency.

- The biggest challenge for many businesses is manually matching funds with payments.

- Virtual Account Management is key to making payments easier to track.

- Many clients view overhauling reconciliation processes as a vital step on their journey to full automation.

What’s the most common reconciliation challenge?

For many companies, the manual aspect of matching funds with payments is a barrier to freeing up staff for other tasks. “The biggest challenge Chaucer faced prior to implementing new, automated tools was being able to recognize which funds needed to be booked where in the ledger,” says Parfett. “We had one account per currency, and all the funds flowed into those accounts. We’re growing, and having to go through and identify hundreds of transactions was becoming a big resource drain.”

“Virtual accounts (VAs) have been fundamental to automating our process.”

What role do virtual accounts play?

Streamlining accounts

The answer for Chaucer was virtual account management (VAM). Parfett says, “Virtual accounts (VAs) have been fundamental to automating our process. For our Irish entity, we opened four physical bank accounts in our core currencies. Within those accounts we created VAs for each branch and currency combination.” Chaucer also created VAs for different settlement types like expenses, reinsurance settlement, claims and tax. Now when statements are received in its Treasury Management System (TMS), a VAM account number is linked to every transaction. Parfett says, “We’re at a point where less than 5% of our transactions are unidentified. The amount of time saved is immense and it’s allowed the team to do the more value-add work, such as analysis.”

How Virtual Account Management works:

- Payments are posted to both a physical central account and a virtual account.

- Because each transaction is connected to a unique virtual account reference, it’s easy to track payments and receipts.

- It cuts down on the amount of client data, such as bank account details, that you need to store, improving security.

Fewer fees and more visibility

Streamlining operations has other benefits too. Chaucer went from six bank accounts and two banking partners to just four accounts and one banking partner. Parfett says, “The transparency we’ve gained is like having 100 bank accounts. We can see what’s available across all the VAs because they roll up into the physical header accounts. We’re not moving money across banking providers or accounts because we can see what our operational cash is every day.” Routine tasks like account opening have also been simplified. “There’s no paperwork, and we can self-serve in the CashPro® portal,” explains Parfett.

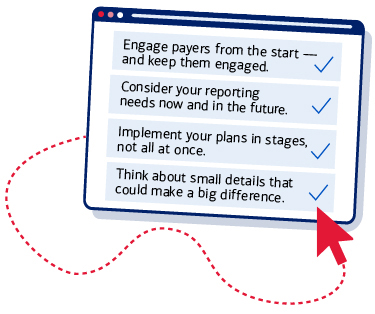

Four implementation best practices

Fewer fees and more visibility

Chaucer’s journey to reconciliations transformation offers insight for other companies on what works and what could be improved:

Engage payers throughout the process

Broker engagement is key, but challenges remain. Parfett says, “Most of our brokers are making different payments into different accounts, but there is a struggle to get people to use the correct bank accounts.” Chaucer found that talking to interested parties throughout the process is a good way to avoid issues. “We approached it in two ways,” says Parfett. “We advised our brokers that we were going to be changing our bank account details and the reasons for doing it. Then we sent out all the correct bank account details. We also want to take it a step further. We’d like to engage with brokers and create some kind of broker statement that they can complete for us.”

Consider your reporting needs

One thing Parfett says she would do differently is reporting: “We opted to take our statements in at the header account level, which works. But it’s restricted the way we can report out of our TMS. We can only report full statements for those header accounts. We can’t drill down and pull information that related to a VA. We rely now on some of the reporting out of the CashPro® portal.”

Approach transformation in stages

Chaucer started its implementation by setting up broker-specific accounts for a single branch in Bermuda. Parfett says, “Looking at a branch was the right thing for us. As it turns out, we didn’t go broker-specific on every branch. Had we at the beginning tried to do that exercise it would have been a huge amount of work for very little benefit.” Pauly says, “One key thing that we’ve seen for successful outcomes is managing the project into separate phases. Think of it in terms of taking on one challenge, getting the solution in place and running successfully and move on to the next one.”

“One key thing that we’ve seen for successful outcomes is managing the project into separate phases.”

Think about the little things

Working out what’s important to you can stop issues from arising. For Chaucer, a small decision to give bank accounts the name of the payer had unintended results. “It’s a very simple thing, but we would look at the way we named broker accounts,” says Parfett. “We get calls from brokers asking if the bank details we’ve provided are correct because it looks like they’re making payments to themselves. It’s a simple tweak to fix, but in hindsight it’s something we’d look at.”

Continuing the receivables journey

“One of the key things I’ve taken away from the conversation is that advanced tools like virtual accounts can enable a multitude of benefits, from reconciliation automation, bank account rationalization and centralization of liquidity visibility,” says King. And it’s just the start. “Our clients look at this as an evolution from where they’re at today,” says Pauly. “They’re looking beyond VAs and focusing on payer identification and general ledger allocation. At Bank of America, we offer a solution called Intelligent Receivables that many will move up to as they progress in the path to full automation.” For Chaucer, advancing receivables reconciliation has been transformative, and has certainly laid strong foundations for further progress.

For more information, talk to your relationship manager. You can also hear the full conversation on our Treasury Insights podcast.