6 minute read

tech outlook Finding the exit: Near-term volatility but long-term optimism delays exits

2025 will remain a tale of the “have nots” and the “have too much” players

Key takeaways:

- Uncertainty around inflation, tariffs and geopolitics is clouding the near-term picture but long-term optimism remains high.

- LPs and VCs have not been able to exit and redeploy monies for 3+ years, leading them to selling stakes in the secondary market.

- The long-term outlook remains positive, particularly around opportunities involving AI.

A year ago, the tech industry’s capital market was stuck. VCs ready to cash in on long-term investments had been waiting more than two years for an exit—and late-stage tech companies were struggling to raise capital. Tech valuations were down. The number of deals were down, and the IPO market was not attractive to stronger tech companies and not available to weaker ones.

The 2024 presidential election outcome altered the outlook. “Immediately after the November election, animal spirits were running very high,” says Mo Renta, managing director and Transformative Technology Group executive for Bank of America. “The markets welcomed the change in the administration, which generally was perceived as pro-business.” In particular, an expected 180-degree shift in the regulatory environment created the expectation that tech M&A and IPO activity would be robust in 2025—promising exit opportunities for investors and funding options for tech companies in need of capital.

That initial post-election euphoria has been tamped down, however, by uncertainty about the president’s broader agenda, particularly the on-again, off-again discussion of tariffs on a variety of products and trading partners—and the response from those impacted countries, especially China. Furthermore, some of our geopolitical alliances seem a bit murky. How would our long-standing Western European allies, particularly Germany react to an ending of the Ukraine War via a US-Russia alliance? The uncertainty has created a headwind and caused some companies to pause major strategic decisions, at least for the time being.

“In 1Q25, the equity markets were healthy. Also M&A activity was gearing up driven by expectations that the regulatory environment for business would be favorable. But there was a sharp turn in April when US announced significant tariffs on countries around the world. People are worried about a possible trade war.”

The inflation outlook is murky

Economists worry that tariffs could worsen the national inflation rates the Federal Reserve has been trying to tame for the past three years. Bank of America expects that core inflation will remain stuck at a near or at the 3% level for the rest of 2025—a rate that, although not crippling, remains above the Fed’s 2% target.

That inflation outlook in turn will affect interest rates. Bank of America forecasts the Fed will make no additional rate cuts for the rest of the year. These higher interest rates could continue to pressure housing affordability and borrowing opportunities, particularly for smaller businesses. This could dampen consumer confidence.

In a nutshell: “While there have been high expectations for robust M&A and IPO activity in 2025, the first quarter has fallen short and the second quarter is not looking good.” Renta says. “And there is a huge backlog of companies ready to go public.” But companies are still holding back, she says, waiting for clearer economic signals and a stronger marketplace. “So far we have seen one software IPO—SailPoint, which was upsized to $1.38 billion, and priced at a reasonable discount to its peers. But after briefly ticking up, it’s been relatively flat or down since that mid-February IPO,” she says.

The struggle to exit

This is the latest chapter in the tech industry’s three-year struggle to get back to a more robust investment climate for investors and maturing startups. The lack of exit opportunities has tied up capital and stymied growth. VCs and LPs have not been able to monetize existing deals. And that has been bad news for the average tech company in need of funding.

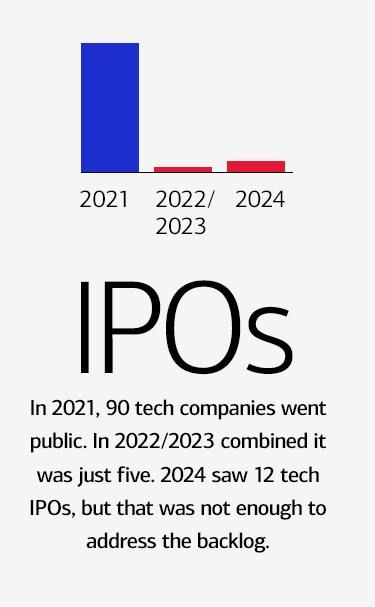

Says Renta: “Every year there should be a harvest of monies that were put into tech companies five, or eight or 10 years earlier. But in the last three years, we have not been able to harvest those vintages through the market.” In 2021, 90 tech companies went public — compared to just five in 2022 and 2023 combined. 2024 showed some improvement, with 12 tech IPOs, but that was not enough to address the backlog. “That means that many VCs, and consequently their LPs, have still not been able to adequately or fully replenish investments and redeploy that capital,” she says.

In addition, as venture capitalists have looked for limited partners—primarily institutional investors—to fund startups, since early 2022 those potential LPs have been able to choose less risky, more liquid investments with good returns. Stocks, money market funds and Treasury bonds have been an attractive alternative to locking up money for five or more years in a VC investment.

While there remains an extensive backlog of strong tech companies qualified to go public and good public market investor appetite, these stronger tech companies have largely remained on the sidelines because of mixed recent IPOs performance. And to be fair, because they are adequately capitalized, there is less of an urgency to go public. “The public company scrutiny and valuation volatility just has not been worth it,” Renta says.

Given the tariff announcements and the macro implications, she questions whether there will be a material pickup in IPOs in the second half of this year, and some LPS and in turn VCs have become increasingly impatient. Seeking an exit, some of these investors are turning to the “secondary market”: selling their existing stake to other investors in a private transaction.

The big picture

Since Inauguration Day, the flood of administration news and executive orders, particularly regarding federal funding cuts and tariffs have made investors jittery and put the key market indexes on a day-to-day rollercoaster ride. Although Renta expects that short-term volatility in the stock market will continue, she says it’s important to focus on the long-term factors and AI-driven productivity gains that will keep the U.S. economy on top.

Looking beyond the tech investor markets, macroeconomic conditions remain generally resilient at the moment. “Many economists, businesspeople and investors expected a recession post-pandemic, but that did not happen — thanks largely to the robust job market and strong consumer spending, which both have proved extremely resilient,” Renta says.

Other indicators of the domestic macro situation: U.S. GDP during the fourth quarter of 2024 grew 2.3%, but BofA recently revised down the GDP estimates for 1H25 from 2.4% to 1.5% due to the trade policy situation. The unemployment rate has been hovering near the lowest numbers since World War II, at 4.2%, and is expected to remain around that level through 2025. Despite persistent inflation in certain categories, consumer spending remains solid, for now.

Still, Renta thinks the potential for inflation to reaccelerate is one of the most underestimated risks in the economy. “Usually when you are getting inflation under control, it’s because you have squashed consumer demand, the unemployment rate has increased and demand has decreased,” she says. “But this time around has been different. A lot of the inflation we saw in 2020 –22 happened as a byproduct of the pandemic — because consumers couldn’t get goods they wanted, tariffs may have a similar effect.”

She says most of the deflationary activity has been supply-chain related, as bottlenecks and other pandemic issues waned. “But if there’s a supply chain issue — like a trade war — inflation could spike again,” she says. “That’s what bothers me; it can change very quickly. In 1Q, we felt that we’ve gotten inflation under control, albeit 3% vs. the target of 2%, but the situation is vulnerable.”

Looking forward

In terms of the venture capital market overall, Renta says 2025 will remain a tale of the “have nots” and the “have too much” players. On the “have too much” side, she says, “We’re seeing mega funds of $10+ billion being created by the largest and most well-known players in the marketplace. And the top unicorns among startups are flush with capital.” The challenge of deploying so much capital, she says, “is forcing VCs to find chunkier investments and leaving some of the most attractive startups with possibly too much cash.”

Of course, over the past several years some of the most intense investor interest has been in artificial intelligence companies, and Renta does not see that interest diminishing. “The question is: In a world where the use case for AI appears infinite, what are the next big investment opportunities, after chips, datacenters and power?” she says. Autonomous vehicles are far along, and she suggests that, U.S.-based manufacturing is next for AI and robotics-fueled transformations that will help domestic facilities sidestep the higher cost of domestic labor. VC interest is also growing for startups that use robots to meet the need of understaffed sectors like healthcare and home care.

“The question is: In a world where the use case for AI appears infinite, what are the next big investment opportunities, after chips, data centers and power?”

AI-focused deals helped the tech industry’s M&A activity reach new highs in 2024. Tech M&A volume increased 32% over the previous year, characterized by increased large-cap volumes and growth in both strategic and sponsor activity. “But 2025 is on hold. It should have been positioned to exceed 2024 with a better regulatory environment, well-capitalized strategic and financial sponsor buyers, and companies focused on M&A as a strategic lever to achieve growth. However companies are frozen on making any major strategic decisions because of the uncertainty around tariffs.” she says.

Liquidity really is a big deal for tech companies

Many companies learned the hard way that liquidity is a company’s lifeblood. When you lose operating money, everyone understands. But liquidity is different — especially for a CFO. You can’t run out of cash.