Payments as a working capital tool

Unlock hidden cash with a strategic approach to payments

Key takeaways

- Vendor payments can be used as a means to extend payment terms and improve vendor health

- A strategic approach to payments can unlock hidden cash

- Optimizing the cash conversion cycle can improve both the income statement and balance sheet.

- It is crucial to sell the business case internally

Free cash flow is critical for corporates, their customers and their suppliers. As businesses seek to unlock cash from day-to-day operations, savvy treasurers have discovered that extending payment terms with their vendors provides an opportunity to improve their own working capital, while improving vendor health.

The benefits of optimizing the Cash Conversion Cycle (Days Sales Outstanding + Days Inventory Outstanding – Days Payment Outstanding) have, in theory, held great promise in improving both the income statement and balance sheet. Here, we outline a three-step roadmap that turns the theory into an action plan, with the goal of unlocking hidden cash while not increasing bank debt through the power of payments.

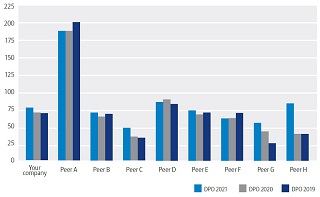

Step 1: Benchmarking vs. the competition

A common question treasurers ask when seeking to extend payment terms is how their companies rank against the competition. The good news is that much of this information is available, or could be modeled by inspecting the quarterly and annual statements of public company peer competitors:

While each company is different, the information above provides a powerful tool that enables a treasurer to evaluate strengths and weaknesses against the competition, and provides clues as to the potential opportunity on whether to increase payment terms. The data above can help set enterprise goals based on a company’s unique business dynamics. Whether the goal is to achieve top quartile status (strengthen a competitive advantage) or close a competitive gap to meet the industry average, companies can quantify the potential cash flow gain to begin socializing the benefits to the broader organization. As the case to proceed further is typically compelling, this work forms the basis for the business case to move to Step 2.

Step 2: Understanding your commercial payments

Not all payment types are alike, and not all vendors are alike. Investing the time to fully understand and strategically segment vendor payments is critical to successfully leveraging payments as a working capital tool.

While there are many moving parts to the above chart, the overarching message is that “one size does not fit all” for vendor payments. Generally speaking, non-strategic vendors and indirect spend suppliers (e.g., office supplies) typically follow the “10/90” rule: 10% of the dollar value, but 90% of the payment volume. A practical goal here is to drive as much of this payment volume as possible to card-based products to increase processing efficiency, extend payment terms through a regular billing cycle, and potentially receive a rebate based on spend volume. Vendors in this group are typically already accepting card payments, making the adoption barriers low. If card payments are not an appropriate solution, Automated Clearing House (ACH) payments can be a good option to lower payment processing costs and improve efficiency.

While the above drives payment efficiencies, the opportunity to leverage payments to increase working capital lies in the strategic sourcing vendors — those that generate 80% of the dollar payment value, but only 20% of the payment volume. Historically, extending payment terms to achieve cash flow gains for this group has been seen as a zero-sum game, where payment terms extension comes at the expense of the supplier. Through a supply chain finance (SCF) solution, buyers can extend payment terms while lowering their supplier’s total cost of financing their receivables. SCF programs capitalize on the interest rate arbitrage generated by the buyer’s strong credit rating to extend payment terms (e.g., from 30 days to 60 days) to vendors with lower credit ratings, and thus a higher cost of funds.

Referencing the highlight in the chart above, substantial payment dollar volume flows to vendors with a higher cost of capital. Assuming a payment terms increase from 30 days to 60 days, and a buyer cost of capital noted by the grey line, these target vendors can discount their payments a few days after the buyer approves invoices, financing their entire receivable at a much lower interest rate. As a result, both parties win: The buyer generates substantial cash flow from payment terms extension, while the supplier’s overall financing cost is lowered by securing sustained access to capital to finance the receivable. With a strong business case for both buyers and suppliers, the next step is to create the action plan.

Step 3: The action plan

For the buyer, the immediate next steps fall into three groups:*

- Creating the financial model

- Selling the internal case for change

- Picking the right financial services provider

(*Note that the ideal provider can — and should — assist with all three.)

Creating the financial model

Through vendor segmentation modeling, establish a phased approach to launch or expand both card-based and SCF programs. Focus on high-dollar vendors that can quickly ramp up results. Quantify the cash flow, rebate and processing cost savings based on forecasted vendor adoption for each phase.

Selling the internal business case

The change contemplated impacts multiple stakeholders, including:

• Accounts Payable

• Finance

• Treasury

• Procurement/Vendor Management

• Technology

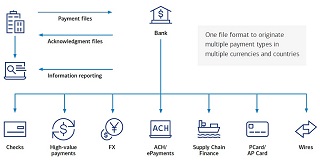

The recommended plan should go beyond outlining the financial benefits reaped by Accounts Payable, Finance and Treasury. For Procurement, vendor health will be an important improvement. For Technology, it will be to reduce complexity as the proposed platform should streamline — not complicate — the operating environment, ideally enabling one file to the bank to handle any/all payment types as follows as the buyer deems appropriate.

Picking the right provider

Choosing an experienced financial services provider that can deliver a scalable, yet modular, platform is only one piece of the puzzle. The best technology in the market will not achieve the buyer’s working capital goals unless it can be easily adopted by suppliers of all sizes and capabilities. Equally important is choosing a proven provider that has the tools and expertise to strategically segment the buyer’s vendors, establish an action plan and product fit for each vendor group, then execute the vendor marketing program to quickly sign and onboard the suppliers to achieve the financial goals.

In summary, there are more tools than ever before to leverage payments as a working capital tool and enable treasurers to have a substantial impact on the bottom line. Developing and executing the strategy can be overwhelming. Assigning a senior sponsor in the organization and engaging the chosen provider up-front to collaborate on the financial model and internal business case are vital to ensuring enterprise-wide buy-in and successful execution.

Working Capital and the Supply Chain

Balance the “magic triangle” of cost, service, and cash to maximize working capital and free cash flow.