The Future of Payments: How Pay by Bank is Transforming Digital Collections

As businesses prioritise seamless customer experiences, Pay by Bank is emerging as a game-changer. This direct-to-bank payment method streamlines transactions, reduces costs and improves cash flow. Already popular across Europe, it offers a secure, frictionless alternative to traditional payments, enhancing conversion rates and customer satisfaction.

5 minute read

Key takeaways

- Direct-to-bank payments are quickly becoming a critical element of an effective digital collections process. They're part of a broader trend in optimising collection processes through open banking technologies.

- Pay by Bank is becoming more well-understood as an alternative to card payments, and offers simplified processes and improved security to reduce dropout ratios in e-commerce.

- The potential uses for Pay by Bank are much broader than e-commerce and can benefit any situation with variable recurring payments. For treasurers planning for the future, investing in these simple capabilities now will create the optionality needed for a best-practice collections process.

Simple, tailored customer journeys matter to all businesses, and companies that prioritise improving customer experiences have a distinct competitive advantage. According to McKinsey research, transformation programmes focused on the customer journey can increase sales conversion rates and customer satisfaction by up to 20% and reduce service costs by up to 50%.1

“Improved and streamlined payment journeys go beyond e-commerce to all industries that are adjusting to changing technology and customer behaviours,” says Chris Jameson, EMEA GPS Cash Management Product Head at Bank of America. “Consumer expectations are paving the way for business-to-business payment innovation.”

“Pay by Bank is now one of the top three payment methods in the UK, Netherlands, Finland, Spain and Germany”

For treasurers, this translates to multiple opportunities for improvement, with working capital benefits as the clear reward. Small improvements in the speed of invoice payments, for example, release trapped cash into the business. Payment optionality is also needed to create scalable, future-proofed customer sales journeys across many channels, so the demand for simplified, secure and efficient payment methods is increasing.

In this context, direct-to-bank payments are quickly becoming critical to an effective digital collections process. Pay by Bank is now one of the top three payment methods in the UK, Netherlands, Finland, Spain and Germany, with 84% of those who use this method reporting high satisfaction with the convenience and security.2,3

What is Pay by Bank?

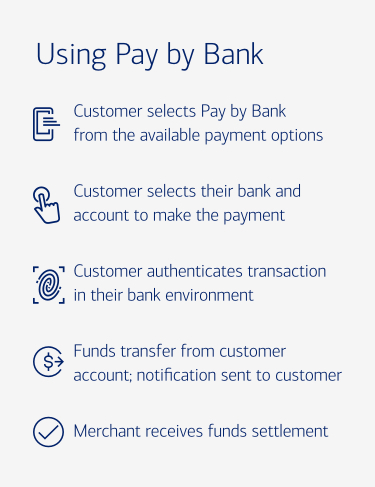

Pay by Bank is a payment method that enables direct transfers between bank accounts, bypassing traditional card networks. It utilises real-time payments, open banking APIs, or Automated Clearing House (ACH) transfers to process transactions securely and efficiently.

When a customer selects Pay by Bank at checkout, they are redirected to their bank’s online portal or app to authenticate the transaction using secure credentials, such as biometrics or multi-factor authentication. Once approved, funds are transferred directly from the payer’s bank account to the recipient’s account. Pay by Bank is bi-directional, which means that merchants can use it to collect customer funds as well as to pay customers for refunds, compensations or claims.

“We are seeing many companies outside of e-commerce starting to incorporate Pay by Bank in their collection strategies”

“We are seeing many companies outside of e-commerce starting to incorporate Pay by Bank in their collection strategies,” says Alex Wong. “A multinational laundry service firm has recently incorporated Pay by Bank into their collections processes to speed up payments from smaller hotel customers. It really shows how wide the application is.”

For regular bill collections, Pay by Bank increases optionality and simplicity to improve collections. While direct debits remain the most popular means of payment in these situations, the secondary card process can be clunky. As consumers become more comfortable with banking apps, Pay by Bank can create a much simpler process through a link or QR code and can improve ageing debt collection processes.

Planning for the future of collections

The growing attention given to Pay by Bank capabilities is part of a much broader trend — a shifting approach to digital collections. As more banks and companies build out new use cases for open banking and API capabilities, the opportunities to rethink collection processes are increasing.

Commercial variable recurring payments (CVRP) are an example of capabilities currently being developed. This technology aims to deploy frictionless digital user interfaces for customer mandate management to give treasurers more control of recurring payments and improve collection rates. CVRP can potentially reduce collection failures and the heavy operational overhead associated with these services. They could completely overhaul the mainstream subscription-based and direct debit services that merchants currently use.

“Even very small, simple technologies deployed at the right point in a process have the potential for significant impact”

Whether it's the future potential of CVRP or the current opportunities available from direct-to-bank payments, the tangible use cases from open banking are becoming better understood and more effectively applied. Even very small, simple technologies deployed at the right point in a process have the potential for significant impact. For payments and collections processes, the future is fundamentally about optionality that simplifies and customises payment experiences.

At Bank of America, we're committed to payment platforms based on open infrastructure that fosters connectivity and continuous investment. Speak to your Bank of America relationship manager now to understand how our Pay by Bank capabilities can help your business evolve your collections processes and keep pace with changing customer demands.

Chris Jameson | EMEA GPS Cash Management Product Head, Bank of America

Alex Wong | EMEA Core Cash Product Management Executive, Bank of America

Shivani Mccormack | EMEA Core Cash Product Specialist

Global Payments

Improving payments through innovation