The why, when and where of notional pooling

7 minute read

Notional pooling is a simple concept. It is a liquidity concentration solution that consolidates balances of multiple accounts or entities, in different currencies, without physically converting individual currencies. However, the question of where to set up a central pooling location is more complex. Treasurers need to understand the advantages of each country and consider what they want to achieve.

Greater visibility and control

Notional pooling helps organizations minimize borrowing costs and maximize returns. Combined with cash concentration, notional pooling allows corporations to automate the movement of funds into a central location, as close to the end of day as possible, while maintaining a target or zero balance in operational accounts globally. This consolidation can enhance working capital, reduce costs, optimize yield and improve daily efficiency. It offers an opportunity to cut through complexity by rationalizing bank accounts, providing greater control and visibility over balances. It is also a simple route to automation, a key objective for many treasurers, which can remove the need for manual movement of funds globally, saving time while reducing the risk of human error. (For more on cash concentration strategies, please see Liquidity Optimization article series.)

A solution for any environment

Notional pooling continues to be a mainstay optimized cash management solution, regardless of other economic factors. In today’s uncertain interest rate environment, we see clients leverage this strategy to gain additional oversight over balances, consolidating pockets of liquidity across regions to maximize yield. We find company-specific factors play into the consideration of notional pooling as a valuable tool in day-to-day management of corporate liquidity.

Select a location that works for you

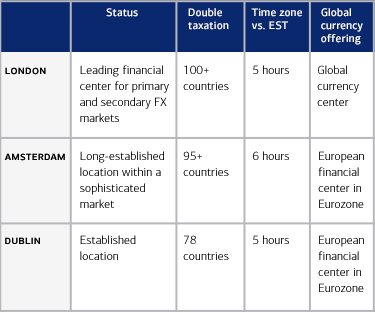

While the benefits of notional pooling are clear, selecting a pooling location requires careful thought. Notional pooling is not permitted in the U.S. because of legal and regulatory restrictions, but there are plenty of options in jurisdictions in EMEA and APAC. Many of our clients choose EMEA, in markets such as London, Amsterdam and Dublin, which are well-established. Where to locate your notional pool may depend on a number of factors for consideration:

- Time zone:

EMEA is a popular location — it provides a natural “follow the sun” centralized hub for liquidity, allowing movement of funds from an APAC notional pool to seamlessly connect with an EMEA notional pooling solution. Optimizing and supporting local operations in regional markets is a key consideration when connecting the funding for operations to a notional pool. Having an extra hour can make a difference for a treasury team aiming to optimize liquidity and ensure efficient funding when comparing London vs. Amsterdam location cut-off times, for example.

- Currency offering:

Consider the number of currencies that are supported in a particular location. Established financial centers with a maximized currency footprint will allow for optimal currency consolidation in a specific location. - Tax and legal environment:

The number of bilateral taxation treaties can mitigate costs and reduce the administrative burden associated with reclaiming withholding tax on cross-border payments, a critical consideration of substantial currency flows. The legal environment is also important, and having some expertise in a country’s legal framework can be a determining factor. - Bank accounts:

Setting up new bank accounts in multiple jurisdictions can be time-consuming. When selecting a pooling location, it can be helpful to consider if you have existing accounts in a currency hub location that can be utilized for consolidating balances to a notional pool. - Familiarity:

Consider how familiar you are with a jurisdiction and how it works, or if you have expertise in that location within your treasury function.

Assess your needs

Your final decision may depend on your current and future state requirements, current bank account locations or where your treasury is located. For example, if you have people in Dublin, do you want your notional pool accounts specifically established there, or likewise, Amsterdam or London? You may also want to consider existing bilateral tax treaties, currency cut-off times and your specific tax guidance to build a solution in the optimal location to support your corporation.

Access solutions built around your company

As a global bank, our clients benefit from our forward-thinking cash concentration solutions across various locations. In addition, we offer an overlay solution incorporating third-party banks, which can support risk diversification. This means you can have a notional pool with Bank of America but retain underlying accounts with third-party providers. These accounts would automatically sweep into the centralized notional pooling location, providing access to the global resources of Bank of America.

Find a path forward

Wherever you decide to locate your notional pool, it can be a win not just for your treasury team but for the whole organization. Notional pooling can help create a more automated, seamless structure for centralizing cash around the globe, increasing oversight and control. For those looking to get started, a good first step is careful planning and quantifying what you want to achieve. To find out more, contact your Bank of America representative.

Hannah Boaden | Managing Director, Treasury Product Executive

Rebecca Pilendiram-King | Director, Treasury Product Manager

Global Liquidity Solutions

Our experienced specialists provide insights and solutions to help you reach your global, local liquidity, and investment objectives.