Healthcare M&A Report

Healthcare leaders are looking to increase market share but face several challenges.

8 minute read

Key takeaways

- Healthcare M&A activity has accelerated as providers slowly recover from the labor expense pressure observed in previous years.

- Earnings remain muted versus historical averages.

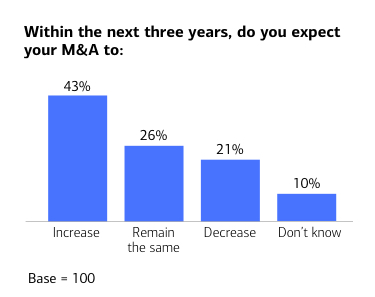

- M&A volume should accelerate with traditional M&As designed to maximize pricing power.

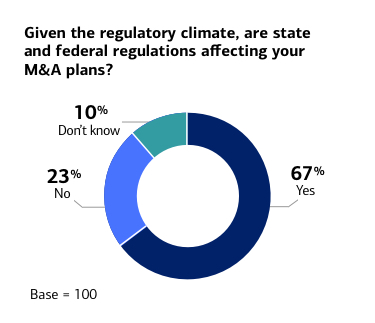

- Significant anti-trust pushback from state and federal regulators is expected.

Bank of America and HealthLeaders present the latest report on M&A activity in the healthcare industry. Through surveys of healthcare executives and data analysis, this report provides an in-depth view on the current state of healthcare M&A and offers an outlook for the future.

“Healthcare providers should be commended for implementing well-craſted and creative solutions to mitigate growth in their largest operating expense component, including standing up internal staffing agencies, successfully recruiting from new talent pools and more efficiently staffing to volume fluctuations.”

The biggest headline in healthcare is consolidation

Across the country, the industry is top-of-mind. Topics range from price transparency, surprise billing, Medicare/Medicaid, hospital at home, telehealth, fraud, drug prices, prior authorization, 340B fights, staff shortages, patient safety, healthcare-acquired infections, nurse autonomy, physician unions, social determinants of health, private equity, primary care “disruptors,” and, of course, AI.

But consolidation remains the big story. The pace of mergers and acquisitions of hospitals, health systems, physician groups and payers is accelerating, and there's no indication it will slow any time soon.

The regulatory environment is a factor

Traditional mergers and acquisitions that are designed to maximize pricing power and pass on as much of the cumulative inflationary expense that providers endured over the last three years onto payers and patients are likely to encounter significant anti-trust pushback from state and federal regulators.

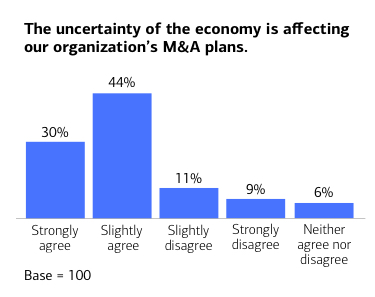

Finances and the economy are a concern

Amid growing wariness by regulators, the media and the public, acquired hospitals are increasingly pursuing M&As to stabilize their finances. Oftentimes, these smaller, cash strapped hospitals have few alternatives to keep the doors open. Additionally, economic uncertainty is still pervasive.

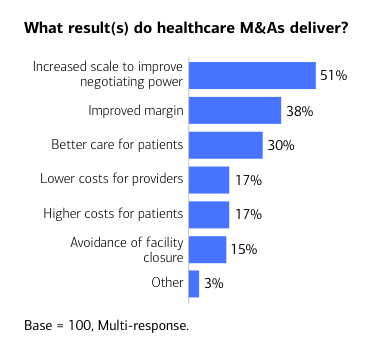

And the debate continues about the results of M&A

Do mergers and acquisitions have negative consequences for patients? While numerous studies have shown M&As result in reduced services, lower care quality and higher cost for patients, some executives disagree.

Through it all, M&A is expected to continue — and increase

As long as there are financially wobbly providers threatening to shutter and looking for a white knight, and as long as there are wealthier systems looking to grow their market share, we can expect healthcare consolidation to continue, regardless of the effects on care quality and cost.

To read more insights and analysis on the state of M&A in healthcare, download the full report now.

Healthcare Financial Solutions

Expertise that takes you to the edge of what’s next