Healthcare M&A Report

Economic pressures, shifting priorities and more regulatory scrutiny are reshaping dealmaking.

8 minute read

Key takeaways

- Today’s healthcare M&A landscape is maturing rather than waning.

- Amid continued uncertainty, healthcare leaders have become more cautious and realistic.

- They’re resetting expectations, prioritizing integration and pursuing selective growth.

- Internal efficiencies rather than just profitability are key drivers.

Bank of America and HealthLeaders present the latest report on M&A activity in the healthcare industry. Through data analysis and surveys of healthcare executives, this report provides important perspectives on the current state of healthcare M&A and offers an outlook for the future.

“As inflationary and labor pressures abate, the healthcare sector continues to show resiliency, with slow but uneven upward trending profitability. Most respondents are taking a cautious approach to near-term strategic growth.”

Healthcare M&A strategy is maturing

The sector is cautiously optimistic about the role M&A plays in an increasingly complex environment, although economic uncertainty is still influencing plans — 80% of executives say it’s having an impact. But even with the challenges of inflation, labor costs and reimbursement, they remain committed to consolidation.

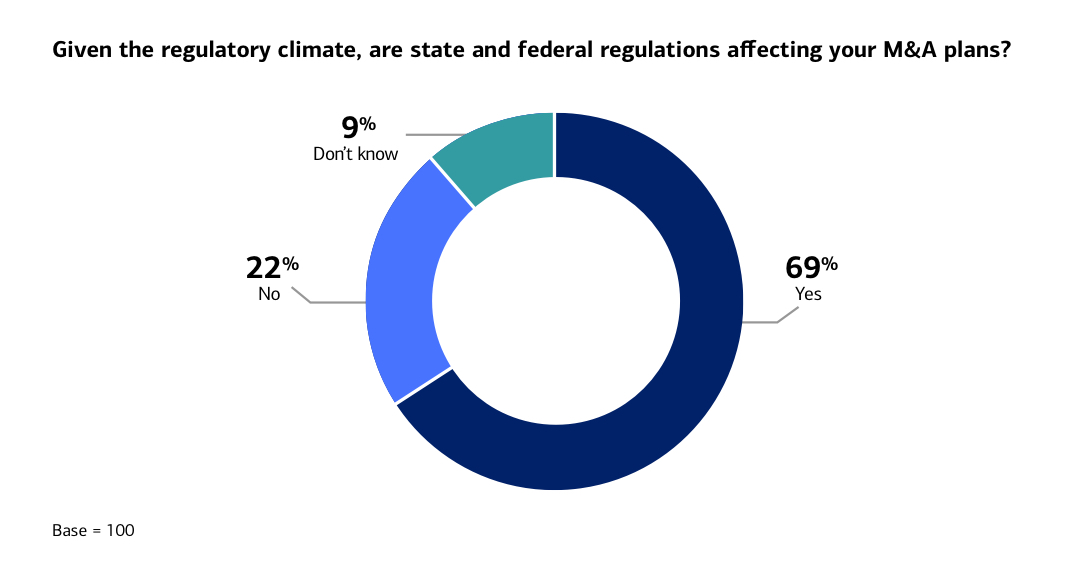

Regulatory concerns are shaping dealmaking strategies

Greater oversight from state and federal regulators is still a concern, and some states are implementing their own review mechanisms. Healthcare leaders are approaching deals with greater awareness of compliance issues and the importance of integration planning.

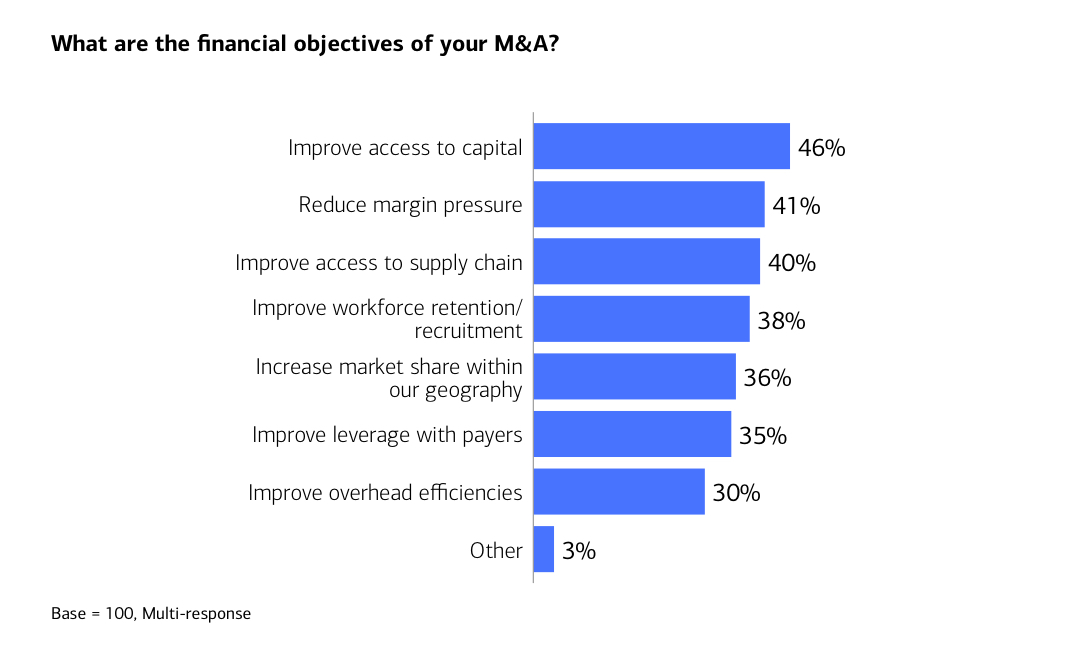

Resilience has become a key driver

M&A is still mainly driven by financial objectives, but internal efficiencies and workforce-related considerations are becoming more important. A combined 68% of respondents say that improving recruitment, retention or overhead efficiency is a key goal, suggesting that organizations are looking to strengthen their staying power.

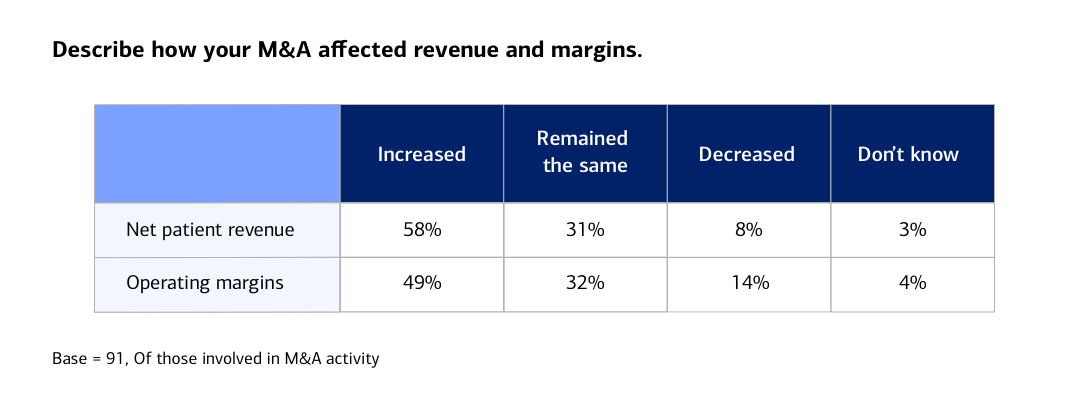

Financial results are mixed

Although M&A may deliver financial benefits, it’s not guaranteed — almost a third of executives saw no change in key metrics after M&A activity. Instead, integration effectiveness, market dynamics and payer contracts all influence whether return targets are reached.

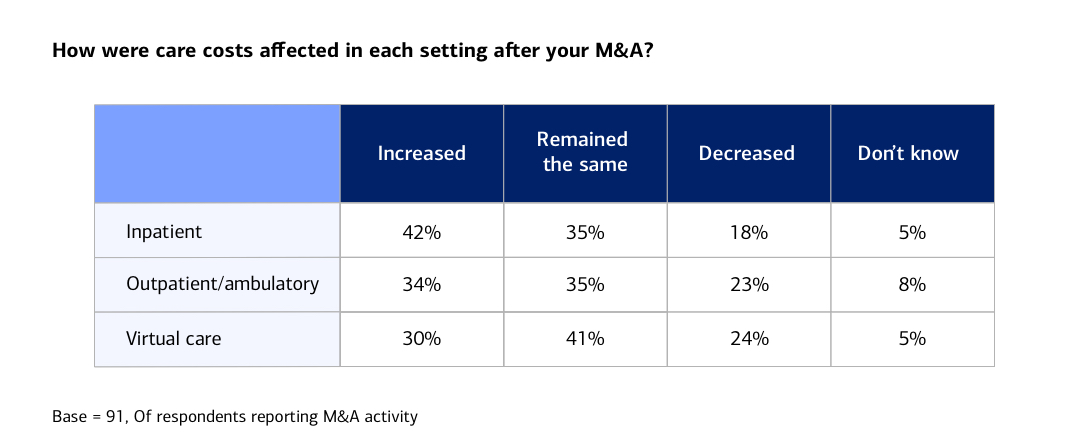

Some executives see new ways to bring costs down

Care costs have either increased or stayed the same across inpatient, outpatient and virtual settings, although some executives reported cost reductions. Reducing expenses is the driving strategy behind M&A for certain CEOs — these leaders are focusing on managing illness and well-being before it becomes an acute issue.

The way M&A success is evaluated is shifting

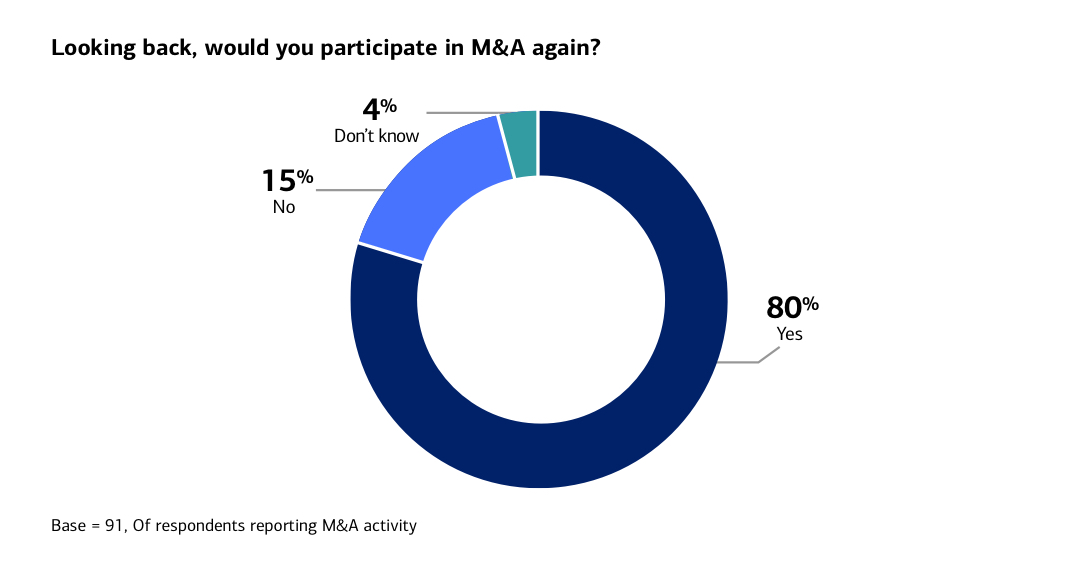

Compared to previous surveys, more executives say they would participate in M&A again. But they’re now applying more rigorous ROI frameworks to their decisions and putting more importance on cultural fit, integration timelines and clinical alignment.

M&A isn’t waning, it’s evolving

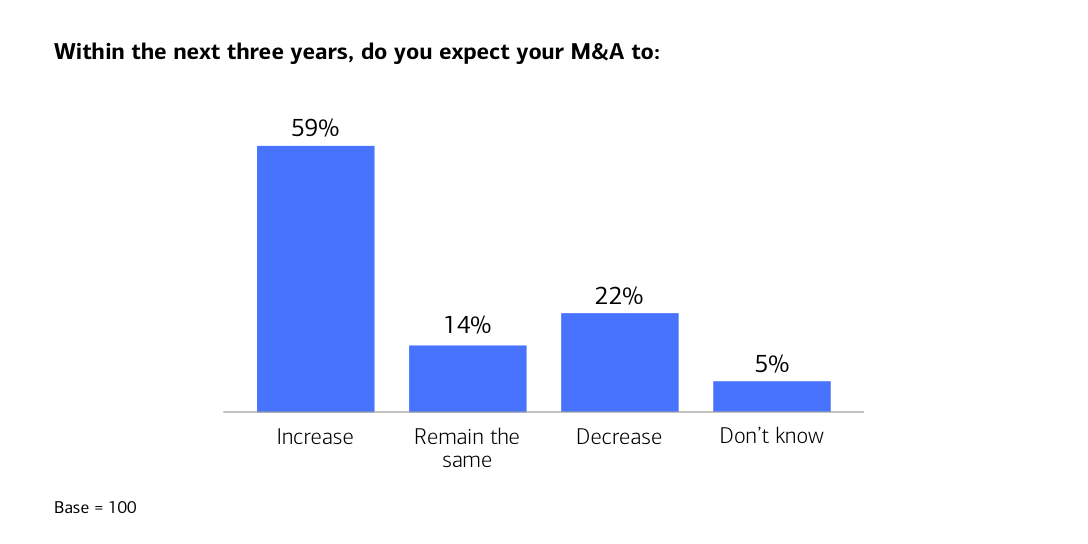

Most executives expect increased dealmaking. While some of this will be driven by financial distress, especially among rural and community hospitals, M&A remains a key element of long-range planning. There are also signs of a more strategic approach, with organizations pursuing deals that offer operational synergies and long-term sustainability. Ultimately, the healthcare industry is still deeply committed to consolidation, but it’s moved from expansion at all costs to selective growth.

To read more insights and analysis on the state of M&A in healthcare, download the full report now.

Healthcare Financial Solutions

Expertise that takes you to the edge of what’s next