War, peace and populism: Looking for opportunities in a new geopolitical era

Michael Hartnett, Chief Investment Strategist, BofA Global Research

Key takeaways

- BofA Chief Investment Strategist warned U.S. equities likely to face disruption

- Gold, bonds are seen benefiting from their perception as relative safe-haven assets

- International equities could come back into favour as the outlook for Europe stabilises, and the Chinese economy experiences a recovery in earnest

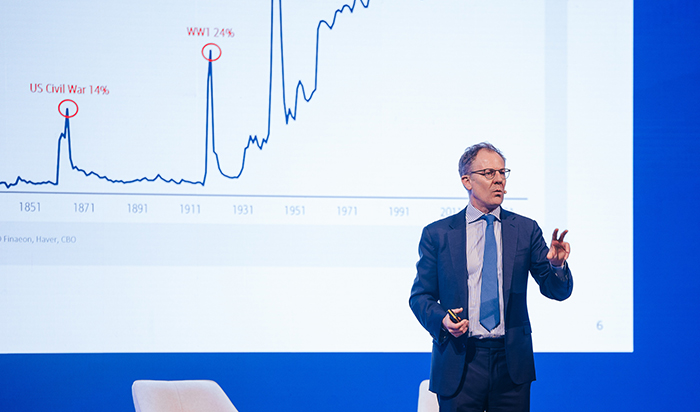

As the global political and economic order undergoes a fundamental realignment, investors will need to develop a new playbook. That was the key message that Michael Hartnett, Chief Investment Strategist for BofA Global Research, delivered in February to the Bank of America Global Investor Summit 2025, which brought leaders and experts from across the worlds of business, technology, policy and even sport to Dubai, in the United Arab Emirates, for a series of in-depth discussions on the outlook for the year and beyond.

With rising inequality and anxiety around issues like immigration contributing to a collapse in support for the global political mainstream, Hartnett warned at the February summit that many of the “old favourites” of recent years – notably U.S. equities – are set to be “dramatically disrupted.” The beneficiaries in this changing of the guard are likely to be what Hartnett termed the “BIG” trio – bonds, international stocks and gold.

Gold is already enjoying a bull run, but according to Hartnett it should continue to benefit simply from its status as a hedge against everything else.

“It's a hedge against uncertainty,” he said. “It's a hedge against policy volatility. It’s a hedge against inflation. It's a hedge against how the world is positioned, which is long U.S. dollars.

Hartnett thinks bonds are likely to outperform expectations due to efforts by the Trump administration to rein in deficits – and because the U.S. economy is likely to surprise to the downside as consumers tighten their belts in response to declining government largesse.

“This is an economy that has been exceptionally strong because of an exceptionally easy fiscal policy,” Hartnett pointed out. “The U.S. economy has grown 50% in five years because government spending has grown 65% in five years … but it won’t anymore. And not only has that growth been an additive to GDP, but it's also been something that made consumers say: ‘What do I need to save?’”

The ‘I’ of the BIG trio – international equities – meanwhile could find more favour as the hopes of massive AI-driven productivity gains that have helped underpin the U.S. market’s lofty valuations fade, Hartnett said. He expects the main beneficiaries to be Europe, particularly if the continent can seize the opportunity to reduce its traditional reliance on Russia for energy, China for exports and the U.S. for defence.

While interest in European and Chinese equities had rekindled in recent months, Hartnett noted investors so far remain fundamentally underweight Europe and China, with for example valuations of the Chinese equivalents of the ‘Mag 7’ standing at a fraction of their U.S. counterparts.

Hartnett pointed out this position fails to take into account China’s rising competitive position in some technologies, like electric vehicles, and, with the debut of DeepSeek artificial intelligence.

What’s more, while there has been a recent push into Chinese tech, “the one thing people don’t expect, and are not positioned for, is an actual recovery in the Chinese economy,” Hartnett said. “If the policy stimulus, the recovery that we're seeing in the housing sector, credit and the wealth effect – which is very powerful in China because of the equity market – if all that translates into the economy actually recovering, and the consumer in China spending; that’s really, really positive for Chinese and international equities.”

Ultimately, if investors can look past the current market and geopolitical turmoil, Hartnett noted there is no shortage of opportunities, or reasons for optimism. A resolution to the conflict in Ukraine, for one, could usher in a period comparable to the post-war periods of the 1950s and 1980s. “Peace is good for international relative to the U.S., and I profoundly hope this will be a more peaceful year,” Hartnett said. “This is not to say that U.S. exceptionalism is over, but I think this year it’s going to take an enormous pause.”

Pearl in a storm: Dubai’s rise as a global hub

With the world bracing for protracted political, economic and market volatility, the lure of jurisdictions that manage to combine forward-thinking policy with predictability/stability will only grow.