Bring your bold ambitions to AFP 2024

Fueling your future with innovative solutions for a digital world

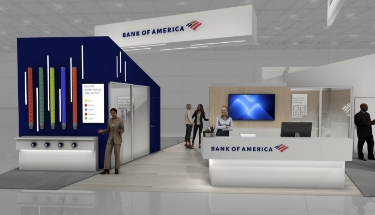

Bank of America at AFP 2024

- October 20-23, 2024

- Music City Center, Nashville, TN

Stop by our booth to add color to the conversation.

“Making things easier for the blocking and tackling. That’s what our clients most want from our innovations. Technology that simplifies and expedites processes so that they can spend time on strategic initiatives. Insights from their own data that show how treasury can be done better. That’s what we deliver through CashPro and our digital solutions.”

Susan Caras | Managing Director, Head of GPS Global Commercial Sales, Global Payments Solutions, Bank of America

“Transaction banking today looks nothing like it did 20 or even 10 years ago. With so much disruption in payments, the landscape almost vibrates with career opportunities. To optimize this potential, the industry needs to attract and retain top talent who can lead us into the next generation of payments and treasury.”

Jay Davenport | Managing Director, Co-Head of GPS Global Corporate Sales, Global Payments Solutions, Bank of America

Related content to AFP

Beyond the Bank: Bank of America’s Strategic Shift to FinTech Collaboration

In a business landscape that moves fast, standing still can be fatal.

Real-time payments: Why aren’t they mainstream yet?

Real-time payments have obvious benefits, including greater control of cash flow, speed of settlement and anytime availability.

Optimizing liquidity operations in a dynamic environment

Key considerations that treasurers should employ when managing liquidity.

Consolidating cash between regions

With rates sitting at a 20-year high with a forecast for gradual easing, companies continue to seek ways to optimize liquidity domestically and across regions, reduce borrowing costs and improve returns on capital.

Global FX Solutions

Our innovative solutions offer an easy way to streamline workflows — saving time and cost and making FX faster, simpler and more secure.

Connected Trade: Transforming global trade finance

Bank of America is innovating to dramatically increase trade finance efficiency and provide real-time visibility through AI and fully automated digital solutions.

Featured Sessions

October 21 10:30-11:30 a.m.

Hello API Payments, Goodbye Batch Processing Pains

As organizations face an increasing demand for seamless efficient payment processing, the complexities of traditional batch payment methods such as the necessity to reprocess an entire batch due to a single payment failure or the complex process of reconciliation has ignited the integration of innovative API solutions. Join this enlightening session as speakers delve into the transformative potential of API payments to mitigate pain points linked with batch payment processing. Explore how embracing this technology can reshape the landscape of payment management for businesses, mitigate errors, minimize manual intervention, and enhance efficiency.

October 21 1:00-2:00 p.m.

Earned Wage Access: A Landmark Innovation in Money Market

Earned wage access has brought much-needed innovation to an archaic, inefficient biweekly or monthly payroll system. It effectively addresses the asynchronous movement of money caused by the traditional pay cycle. The delay impedes consumers from making timely purchases, merchants from selling their products when they need to, and banks from facilitating these transactions due to their non-occurrence. A panel of experts discusses the considerations for integrating wage access in your organization's treasury and finance functions, the implications on cash flow and its role in the infrastructure of major financial institutions nationally.

October 21 3:00-3:30 p.m.

Impacts of Payments Transformation for Banks

The banking industry is shifting significantly towards digital real-time payments and moving away from cash and checks. As this transformation occurs, banks must find ways to succeed in the new digital marketplace. Banks are also encountering 24x7 fraud exposure as part of this industry transformation. Although observed fraud has not been as severe as initially expected, early payments have been of lower value. As the value of real-time payments increases, fraud will likely increase as well. Moreover, cross-border payments will become more common as the real-time payment infrastructure expands to serve clients better. This session explores the implementation of real-time payment services by banks while maintaining safety, efficiency, and security.

October 22 8:30-9:30 a.m.

Concentrating Cash Across Borders: Beyond Repatriation

With countless variables to consider, the challenges that global organizations face to effectively manage their cash is becoming increasingly complex, making access to accurate and timely data critical. A panel of experts in managing global cash share the repatriation strategies, practical insights into their global cash positioning, and actionable process improvements to help ensure effective management of global cash. Discussion includes best practices to effectively manage cash and the impact of technology on strategy and process.