How can family-run dealerships protect their legacy?

Preserving the heritage of a multigenerational dealership takes hard work, strategic adaptation and trusted advisors.

9 minute read

Key takeaways

- Having honest discussions to figure out who will take over the family dealership is a key step for business owners.

- Planning for the shift involves adopting best practices for a seamless transition well in advance.

- If plans change, being prepared for a sale to an outside buyer can help owners make the most of current high valuations.

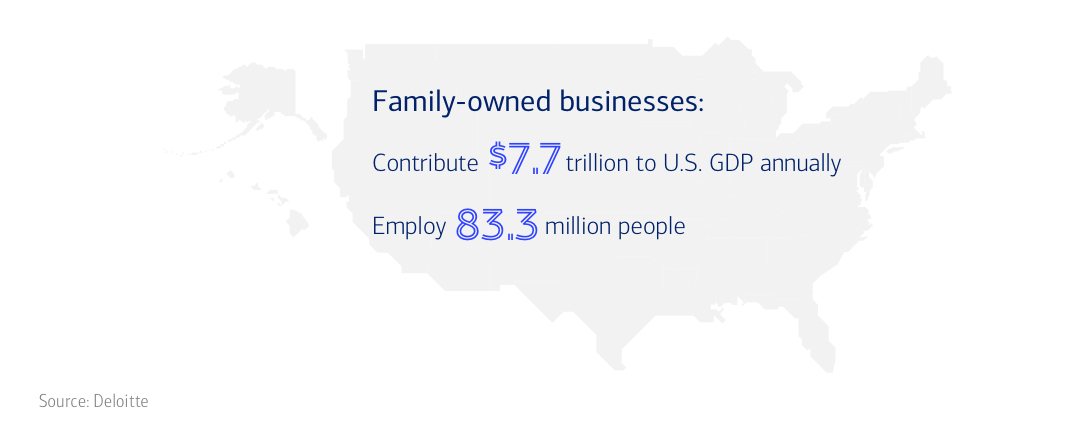

Family-owned businesses have been a foundation of the U.S. economy since the country’s creation. Today, some 32 million family-owned businesses contribute $7.7 trillion to U.S. GDP annually, employing 83.3 million people, according to the 2024 Deloitte Family Enterprise Survey. Many of those 32 million businesses are auto dealerships — where the family name is often right on the door.

Some 85% of dealerships are family-owned, analysts have estimated. Despite industry consolidation and the rapid growth of a handful of large publicly held companies, 91% of the country’s 17,000 new-car dealers still own between one and five rooftops, the National Automobile Dealers Association (NADA) reports; 98% own fewer than 25 locations. Thousands of those dealerships and dealership groups are second, third or even fourth-generation businesses.

How do family-run dealerships like these maintain the values that have made them successful: an entrepreneurial spirit, a hands-on approach, and a dedication to their local community that’s been cultivated over generations? How can a dealer principal protect that legacy into the future, whether the business ultimately remains in family hands or not?

Engage and prepare future generations

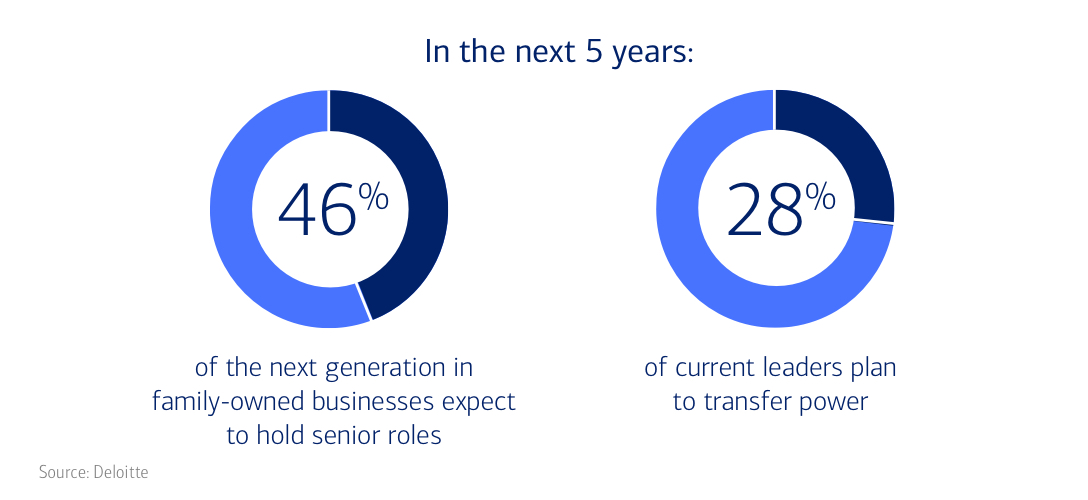

Not every dealer’s child will be interested in the family business, but many will. Among all family-owned businesses, Deloitte found that 46% of the upcoming generation expects to hold leadership or executive-level roles within five years, and 28% of current leaders plan to transfer power within that timeframe.

Figuring out who will take over the company is critical for a business owner, and it’s usually an especially personal moment for a dealer principal. “Succession planning is probably one of the most important elements of our clients’ business,” says Marisa Carnevale-Henderson, Bank of America Market Executive. “It’s always a good idea to examine, simplify and solidify existing ownership structures to avoid problems later on.”

“Succession planning is probably one of the most important elements of our clients’ business. It’s always a good idea to examine, simplify and solidify existing ownership structures to avoid problems later on.”

Dealer principals can have honest discussions with children and other family members early, to figure out who is interested and how they can prepare to join the business. Dealers have a variety of approaches to educating and training their children to take over. Our Bank of America team often sees dealers ask their children to graduate from college and to attend NADA Academy. It’s also typical to have a potential future dealer spend time working in every department at the dealership, to become comfortable in the dealer’s role as a master of all trades.

The dealer principal generally serves as mentor to their son or daughter, but some dealers find a peer dealership where their child can gain industry experience and also a close-up view of how other companies function. Other dealers insist that their potential successor spend a specified amount of time working outside the auto industry completely, before returning to take over the family business.

Structure for a successful transition

Preserving the heritage of a multigenerational family business is the result of hard work, strategic adaptation and dedicated wealth management. The dealer principal and the leadership team should consider best practices for the enduring success and seamless transition of their enterprise.

In addition to identifying potential successors, a dealer can help ensure a smooth transition by establishing a set of key advisors: an attorney or legal team, accountants, and financial advisors. These professionals are not like a dealership’s other vendors; they are long-term, close advisors who can offer strategic and unbiased perspectives, help families focus on long-term goals, and bridge generational gaps.

It's critical to make sure the organization’s financial house is in order. That includes proper financial management, including solid accounting practices and clear, regularly reviewed — and possibly audited — financial statements.

It also means having the right management and leadership team committed to the business, regardless of whether the next generation is going to take over or not. “The business has to be on a solid financial footing for the thought of a sale or ownership transfer. And it’s so important to have the right team in place so that the next generation has options about what to do,” Carnevale-Henderson says.

“You can’t overstate how important people are to this industry,” says Jim Cockey, Bank of America Market Executive. “A good general manager makes all the difference for a dealership organization. So a critical part of planning ahead for a transition is talent assessment.”

“You can’t overstate how important people are to this industry. A good general manager makes all the difference for a dealership organization.”

Preserve the legacy of giving

Auto dealerships are mainstays of their communities, supporting everything from youth sports to local charities and fundraising efforts. Some 81% of family-owned businesses told PwC that they contribute to their communities, and the percentage among dealerships is almost certainly higher than that. However, preserving philanthropic values isn’t a passive activity.

Estate planning can help organize the family’s giving, as well as provide the legal and financial framework to ensure those goals are sustained. For example, a dealer principal can establish a family foundation, a charitable organization set up and controlled by a family to promote selected philanthropic causes.

As a dealer principal transitions out of day-to-day control of the business, he often remains involved — or becomes even more involved — with the dealership’s philanthropic activities, helping to steer giving and priorities.

Prepare for the “what if”

Dealer principals who built their businesses step by step with their own hard work may find it difficult to accept that the next generation of family members may not want to continue as owner-operators. But it’s important to prepare the business for that possibility.

“Unfortunately, we do see instances where a second or third generation does not want to get involved in the family business,” says Carnevale-Henderson. “That’s where we can be instrumental in helping them through.”

If children don’t want to participate in day-to-day business operations at the dealership, the ownership might reside in a family trust, Cockey says, with professional managers running the business for the family.

But it’s critical to take steps in case those who inherit the dealership business opt to sell it outright. “The dealership business is much tougher today, but dealerships remain extremely valuable,” says Derek Comestro, Bank of America Market Executive. “As they near retirement age, some dealer principals may themselves opt to cash in on today’s high valuations, thus providing future financial security for their family.”

If a successful dealership business will be sold, the purchaser will almost certainly want the company’s key leaders to stay in place. “Retaining those employees increases the value of an acquisition,” Carnevale- Henderson says.

“Dealerships remain extremely valuable. As they near retirement age, some dealer principals may themselves opt to cash in on today’s high valuations.”

Focus on people, process and execution

Buy-sell activity in the dealership space set a record in the 12 months ending in June 2025, with 454 transactions completed, according to Kerrigan Advisors. Buyer interest remains high, says Comestro. “We will continue to see mergers and acquisitions and continued consolidation in the dealership space,” he says. “But I think we’ll also see family businesses in the space flourish. It’s not one or the other.”

Comestro says, “When it comes to running a dealership, the three biggest expenses are the inventory, the people and the real estate. More so, it doesn’t matter if you have 50 dealerships or one — those costs will be the same. That’s not to say that large dealer groups don’t have some cost synergies, but rather the cost of inventory, people and RE are the same, no matter who owns the dealership. In summary, we continue to see both small dealer groups, as well as large dealer groups, have success. At the end of the day, it truly comes down to people, process and execution, not size.”

Derek Comestro | Market Executive | Dealer Financial Services | Bank of America

Marisa Carnevale-Henderson | Market Executive | Dealer Financial Services | Bank of America

Dealer Financial Services

Dealers face complex challenges and we deliver specialized auto industry expertise and solutions to help you succeed.