The impact of workplace benefits on small business confidence and growth

Learn how tailored workplace benefits can reduce turnover and boost productivity for your small business.

Written in partnership with YFS Magazine.

Affordable, tailored benefits are more accessible than ever for small businesses. These comprehensive programs enable smaller organizations to attract and support their teams effectively.

“Many small businesses assume they can’t afford to offer workplace benefits,” says Lorna Sabbia, Head of Workplace Benefits at Bank of America. “However, affordable options and strategic partnerships are making comprehensive benefits programs more accessible than ever for small businesses.” The best part? You don’t need a massive budget—just the right strategy and partnerships.

Lorna Sabbia

Head of Workplace Benefits

Bank of America

"Many small businesses assume they can’t afford to offer workplace benefits,” says Lorna Sabbia. “However, affordable options and strategic partnerships are making comprehensive benefits programs more accessible than ever for small businesses.”

Tailored benefits drive growth by offering retirement plans, health insurance, equity awards, and financial wellness programs that make a tangible impact, no matter your company’s size or budget. With the right partners, setup becomes easier, expenses are reduced, and you build confidence among your team.

How small business benefits brive business impact

Some small business owners may see workplace benefits as another expense. But when viewed strategically, these benefits prove to be much more valuable. There’s no need for an enterprise-level budget to access significant advantages. When aligned with employee needs, benefits help maximize resources, improve productivity, and reduce turnover, ultimately supporting your bottom line.

Reduce employee turnover and boost productivity

Workplace benefits help address employee turnover and productivity—which are key to organizational stability. According to Gallup, 51% of U.S. employees are looking for new jobs, but tailored benefits can help your small business mitigate this turnover risk.1

In today’s job market, small businesses can thrive—and CEO Davia Ward, founder of Healthcare Partners Consulting & Billing, knows how. “At HPC, we’ve implemented mental health stipends and career advancement tracks designed around the needs of working mothers and second-chance professionals,” she explains. As a result, “we’ve reduced turnover by over 60% and boosted employee productivity by 40%.”

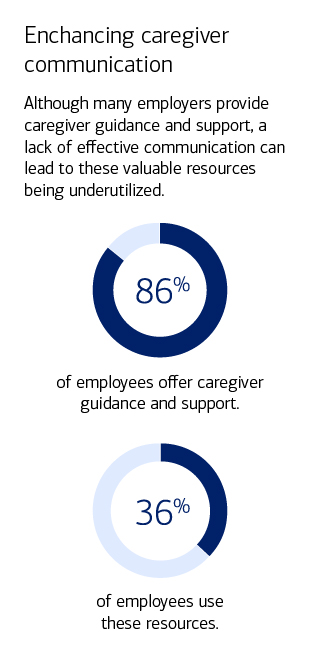

Caregiver support can also be a powerful benefit for employees. However, while 89% of employers offer caregiver guidance, only 36% of employees use these resources.2 Strong communication about the value of caregiver support is key, especially for supporting the financial well-being of parents and other caregivers.

Source: Bank of America 2025 Workplace Benefits Report

Bank of America data shows 58% of men—and just 41% of women—feel financially secure. As more women join the workforce, small businesses can tailor benefits to attract and retain top female talent.

Ward adds, “That level of loyalty and performance is impossible to buy with a generic benefits package.” Athena Kavis, founder of Quix Sites, agrees: “One targeted benefit that solves a real problem for your workforce will outperform five generic ones every single time.”

Align workplace benefits with HR metrics

Benefits have a measurable effect on HR key performance indicators. Jun Zhu, founder and chief scientist at Shengshu Technology, found that giving employees benefit choices—like 401(k) matching versus student loan assistance—delivered better engagement and reduced waste. This focused approach improved satisfaction and cost efficiency.

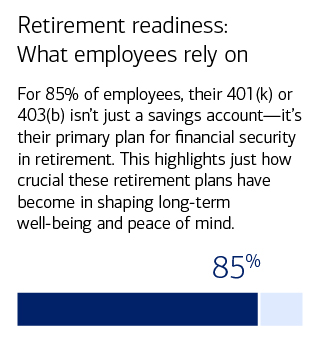

Research from Bank of America underscores this priority: 85% of employees view their retirement plans as their primary source of retirement income.

Source: Bank of America 2025 Workplace Benefits Report

“During the first 12 months, time-to-fill decreased from six weeks to less than four, offer acceptance increased by 15 to 20 points, and regretted attrition decreased by almost half,” Zhu explains. “We closed more quickly and replaced fewer employees, reducing hiring costs.”

Workplace benefits also support business growth and attract investors by helping manage financials effectively.

Optimize burn rate calculations to attract investors

As companies grow, clear employer benefits can make the difference when pitching to investors. These programs help clarify labor costs and reveal how compensation strategies affect financial performance.

According to Charles Kickham, Managing Director at Cayenne Consulting, “Companies with streamlined benefits see 25-30% less monthly variance in payroll expenses, which means your cash flow projections actually mean something when you’re presenting to investors.” A visible commitment to employees signals an ability to create lasting, measurable value.

Elevate client outcomes and drive referrals

Benefits like professional development stipends through Lifestyle Spending Accounts can enhance both employee skills and customer experience. Divyansh Agarwal, founder of Webyansh, shares, “Our developers could access $2,000 annually for courses and certifications, but only after completing projects on time. This drove our on-time delivery rate from 78% to 94%, which translates to better client reviews and 40% more referral business.

Quality benefits drive higher customer satisfaction, which can lead to measurable business growth. Deloitte notes that client-centric companies are 60% more profitable than less customer-focused peers.3

Support employees’ top financial goal: Retirement savings

For small manufacturers, retaining skilled workers is a challenge that can be tackled through meaningful benefits. A Manufacturing Institute study points to health insurance, 401(k), ESOP, and tuition reimbursement as crucial for retention.4

When RiverCity Sportswear started full retirement matching for its 75 employees, turnover dropped by 62%. CEO Luke Sanders says, “What most small manufacturers miss is how benefits affect a small business’s ability to bid on larger contracts…our stable workforce means predictable production schedules.”

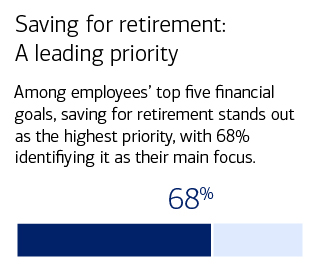

Supporting employees’ financial goals—like retirement—reduces stress and boosts productivity. Bank of America data shows 68% of employees see saving for retirement as a top priority.

Source: Bank of America 2025 Workplace Benefits Report

Create a winning culture through internal ambassadors

Building strong culture through benefits creates internal ambassadors—employees who champion your company values and drive innovation. “Our weekly brainstorming sessions that led to pivotal product developments happened because employees felt invested in the company’s success,” says Chase McKee, CEO and founder of Rocket Alumni Solutions. “When you tailor benefits to what your specific team values, you’re not just retaining talent, you’re cultivating internal ambassadors.”

Well-chosen benefits reinforce a company’s mission and lay the foundation for long-term success.

Make customization a vital part of your workplace benefits strategy

Workplace benefits matter at every small business size—they cut turnover, drive productivity, and help you build a happier, stronger team. Streamlining and customizing your approach enhances both employee experience and business outcomes.

Focused investment in well-designed benefits demonstrates commitment to employees, inspiring trust and loyalty that fuel sustained growth. By investing in the right benefits—thoughtfully designed for your team—you empower your small business to thrive for the long run.

Three quick tips to customize your workplace benefits program:

- Keep benefits simple, with clear business value and direct relevance to employees.

- Offer manageable customization to avoid overwhelming employees and make personalization easier.

- Collect employee feedback with anonymous surveys, and provide clear compensation statements showing salary, taxes, and benefits.

Connect with a team member today.

Discover how we can empower your employees through powerful tools and personalized guidance.

YFS Magazine is not an affiliate of Bank of America Corporation

1 Gallup, Employer Retention & Attraction

2 Bank of America 2025 Workplace Benefits Report

3 Deloitte, Wealth Management Digitalization Changes Client Advisory More Than Ever Before Issue 07/2017.

4 The Manufacturing Institute, Manufacturing and engagement retention study