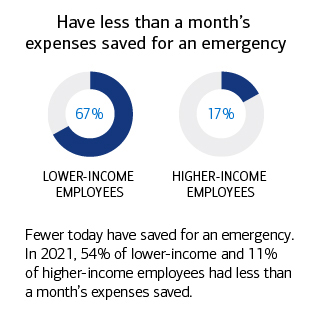

Against a backdrop of inflation and economic uncertainty, employees are stressed about their finances. They’re feeling the impact, and there’s growing evidence that the majority lack the financial skills necessary to tackle such challenges.

Sixty-six percent of employees are stressed about their financial situation, and 76% believe that the cost of living is outpacing growth in their income.1 When employees are stressed about their finances, it has deep impacts on workplace productivity, creativity and morale. The good news is that employees are looking to their employers for help, and we’ve seen employers’ sense of responsibility grow, significantly expanding the scope of financial wellness programs.

This 2025 study focuses on understanding — through a generation, gender and income2 lens — the financial wellness of 88,735 401(k) participants on Bank of America’s record-keeping system. We’ve also included trend analysis from 135,195 401(k) participants in 2021,88,714 participants in 2022 and 105,127 participants in 2023. The findings can help employers gain a greater understanding of employees’ behaviors and financial needs so they can better tailor workplace benefits programs that inspire employees to take action to help improve their financial health.