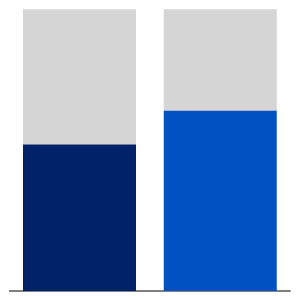

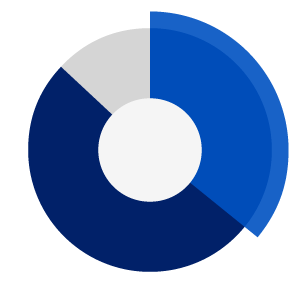

Automatic programs remain the most effective way to promote participation in voluntary savings programs like 401(k) plans and can help put employees’ inertia to work for them as they pursue retirement. The SECURE 2.0 Act requires all new 401(k) plans—adopted after the December 29, 2022, effective date—to include automatic enrollment at a rate between 3% and 6% and automatic increases up to a rate between 6% and 10%. While this is not required for plans established prior to that date, it is a signal from Congress that automatic programs are considered a best practice.