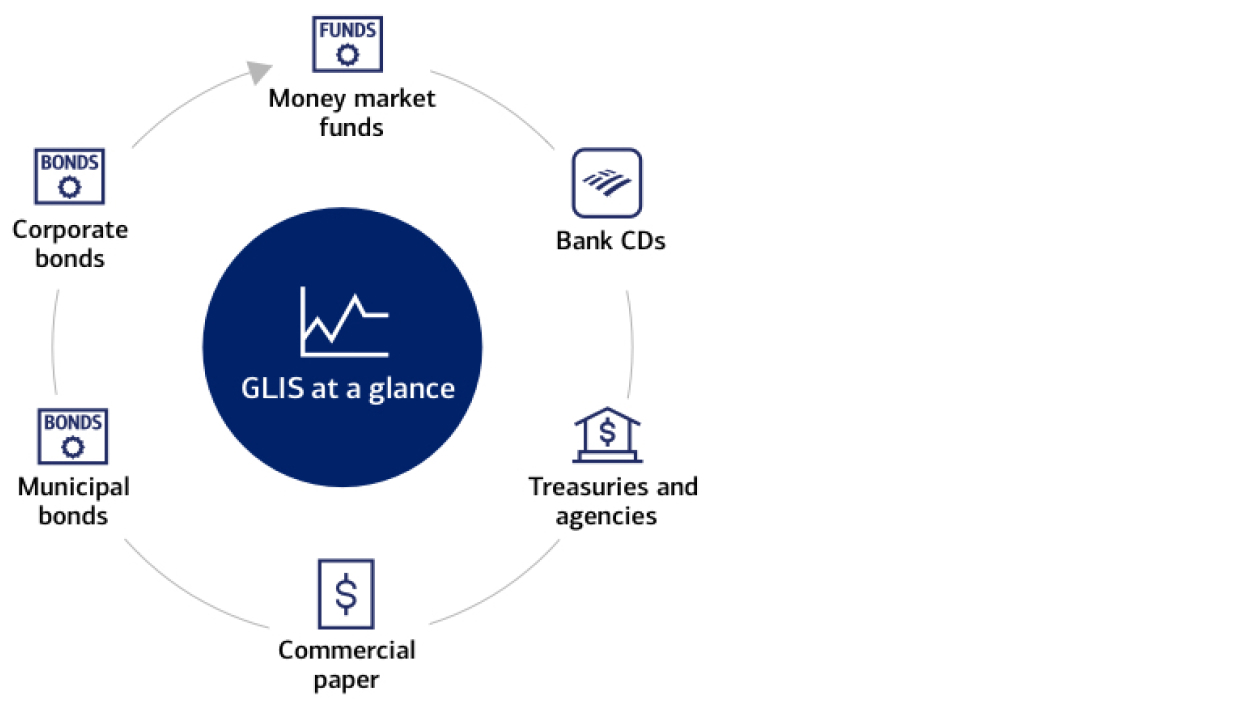

BofA Securities, Inc. ("BofA") GLIS team works with you to support the growth of your business, providing end-to-end liquidity and investment solutions delivered in a consultative and integrated approach that is unique in today’s marketplace. We support institutional, large corporate and middle market companies, as well as nonprofits and government entities. GLIS offers a full array of products including Bank of America, N.A., liabilities, a full spectrum of fixed income securities, third-party money market mutual funds and short-term bond funds.

Global Liquidity Investment Solutions ("GLIS")

Full range of short-term fixed income products

Our liquidity investment portal offers access to a full range of short-term fixed income products including commercial paper, certificates of deposit, agency discount notes, treasury bills and money market funds. It delivers fast, live execution and is seamlessly accessed through your existing CashPro® login. The portal connects you directly to our trading desks with real-time pricing. You can easily view liquidity products, evaluate appropriate options and immediately execute trades with no additional costs and without having to call the desk.

Other resources include up-to-date information and intelligence to help you evaluate liquidity instruments, plus robust documentation for record-keeping purposes. With CashPro Invest, you can view investment account balances, plus download statements and transaction history.

You can benefit from:

- Trusted expertise from qualified investment professionals, especially in dynamic market conditions

- A single point-of-contact who understands your objectives and helps add value to your business

- Access to the fixed income market through one of the world’s largest broker-dealers via CashPro

- Enhanced access via CashPro Invest, our BofA investment portal, which provides access to an expanded suite of fixed income products

Complementary services — CashPro Information Reporting

CashPro Invest works in tandem with the CashPro Information Reporting service, to help you better manage investable balances and maximize your working capital.

CashPro Invest key features

Order entry and research

- View and download mutual fund information including prospectuses, fact sheets and annual reports

- View current rate offerings for bank liability products

- Enter mutual fund, bank liability product and fixed income securities trades

- Track and compare money market mutual funds per user selection

- View a dashboard of your top portfolio holding exposure by various categories, including by country and issuer

- Enter same-day and future-dated orders for money market mutual funds

- Receive maturity and trade notifications by email

- Send straight-through reporting to treasury workstations and ERPs via BAI and XML

Products offered

BofA Securities, Inc.

Fixed income securities

- Government securities including U.S. Treasuries, government-sponsored enterprise ("GSE") securities and sovereign/supranational securities

- Municipal securities including variable rate demand notes, municipal notes and bonds, and municipal commercial paper

- Global credit products including corporate notes and structured notes

Money market instruments

- Commercial paper

- Certificates of deposit

Third-party institutional money market mutual funds

- Allspring

- BlackRock

- Dreyfus

- DWS

- Federated

- Fidelity

- First American

- Goldman Sachs

- HSBC

- Invesco

- JP Morgan

- Morgan Stanley

- Northern Trust

- State Street

- UBS

- Western Asset

Separately Managed Accounts (SMAs)

- BofA Securities, Inc. also has various SMA referral partnerships with asset managers for clients looking for customized, separately managed accounts

Bank of America, N.A.

- Bank of America, N.A. ("BANA"), certificates of deposit

For more information, contact your BofA representative.

NOTICE TO RECIPIENT

Securities products are offered by BofA Securities, Inc. (“BofAS”). Non-securities products (including deposit products) and services are offered by Bank of America, N.A. (“BANA”), a national banking subsidiary of Bank of America Corporation. For more information consult your Global Liquidity Investment Services representative.

No representation or warranty, express or implied, is made as to the accuracy or completeness of this information and nothing contained herein is, or shall be relied upon as, a representation, whether as to the past, the present or the future. These materials are being furnished and should be considered only in connection with other information, oral or written, being provided by us in connection herewith. These materials are not intended to provide the sole basis for evaluating, and should not be considered a recommendation with respect to, any transaction or other matter. This material is for informational purposes only and does not purport to contain all of the information that may be required to evaluate a transaction. These materials do not constitute an offer or solicitation to sell or purchase any securities or other products and are not a commitment by Bank of America Corporation or any of its affiliates to provide or arrange any financing for any transaction or to purchase any security or product in connection therewith.

Bank of America Corporation and its affiliates (collectively, the “BAC Group”) comprise a full service securities firm and commercial bank engaged in securities, commodities and derivatives trading, foreign exchange and other brokerage activities, and principal investing as well as providing investment, corporate and private banking, asset and investment management, financing and strategic advisory services and other commercial services and products to a wide range of corporations, governments and individuals, domestically and offshore, from which conflicting interests or duties, or a perception thereof, may arise. In the ordinary course of these activities, parts of the BAC Group at any time may invest on a principal basis or manage funds that invest, make or hold long or short positions, finance positions or trade or otherwise effect transactions, for their own accounts or the accounts of customers, in debt, equity or other securities or financial instruments (including derivatives, bank loans or other obligations) of the Company, potential counterparties or any other company that may be involved in a transaction. Products and services that may be referenced in the accompanying materials may be provided through one or more affiliates of Bank of America Corporation. We are required to obtain, verify and record certain information which will allow us to identify transaction participants and their principals in accordance with the USA Patriot Act and such other laws, rules and regulations as applicable within and outside the United States.

An investment in a money market mutual fund is not a bank deposit, and is not insured or guaranteed by BofAS, BANA or their affiliates, the FDIC or any other governmental agency and it is possible to lose money by investing in a fund. Constant NAV funds ("CNAV funds") seek to maintain a constant net asset value of $1.00 per share; however, the net asset values of money market fund shares can fall, and, in infrequent cases in the past, have fallen below $1.00 per share, potentially causing shareholders who redeem their shares at such net asset values to lose money from their original investment. If the net asset value of a CNAV fund’s shares were to fall below $1.00 per share, BofAS and its affiliates (including BANA) would not protect the redeeming shareholders against a loss of principal. For fluctuating NAV funds ("FNAV funds") whose share prices fluctuate, investors may lose money by selling shares of FNAV funds at a lower price than they paid for them. Also, for FNAV funds, the fund may at certain times require a fee in order to redeem its shares. An FNAV fund may also restrict redemptions at certain times if the fund’s liquidity falls below a specific level due to extreme market conditions or other factors. These features could restrict investors’ ability to access their assets and could impair liquidity. Please see the fund’s prospectus and statement of additional information for a complete discussion of these and other principal risks of investing in the fund.

Please be advised that with respect to transactions in shares of money market mutual funds or any other transactions designated in Rule 10b-10(b)(1), in lieu of an immediate confirmation, BofAS will provide a monthly or quarterly written statement.

BofAS offers its clients investments in the money market mutual funds of a number of fund families. BofAS may receive compensation from these funds and/or their affiliates or service providers. GLIS representatives benefit financially from this compensation.

We do not provide legal, compliance, tax or accounting advice. Accordingly, any statements contained herein as to tax matters were neither written nor intended by us to be used and cannot be used by any taxpayer for the purpose of avoiding tax penalties that may be imposed on such taxpayer. If any person uses or refers to any such tax statement in promoting, marketing or recommending a partnership or other entity, investment plan or arrangement to any taxpayer, then the statement expressed herein is being delivered to support the promotion or marketing of the transaction or matter addressed and the recipient should seek advice based on its particular circumstances from an independent tax advisor.

CashPro is a registered trademark of Bank of America Corporation.